The Most Maxed-Out Places in America

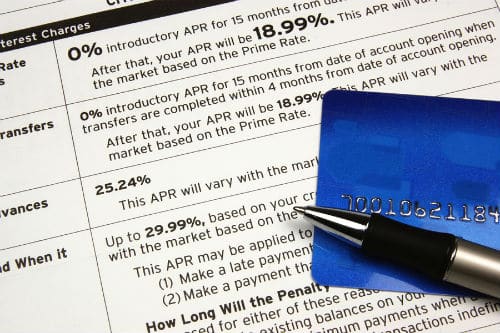

Credit card balances in the U.S. now total roughly $1 trillion, the most since 2009, according to recent Federal Reserve data. While not all those balances represent debt that won’t be paid off each month, many consumers do struggle with credit card debt. One clear signal that a consumer might be in trouble with credit …