The Earned Income Credit (EIC), also known as the Earned Income Tax Credit (EITC), is designed to help you keep more of your hard earned money.

It is a refundable tax credit, meaning you could qualify for a refund even if you did not have any income tax withheld from your paychecks. This article explains who is eligible for it, how much its worth, and how to claim it.

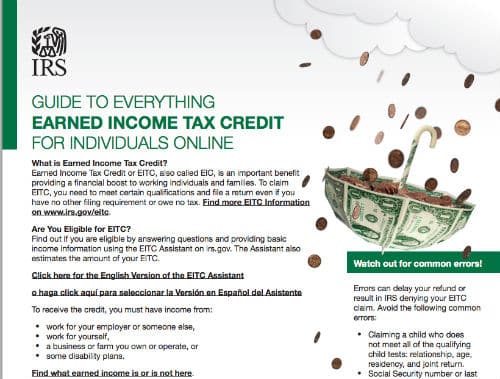

Am I Eligible for the Earned Income Credit?

To qualify for the EIC, you must have earned income from employment, self-employment, or another source and meet specific rules. Your income has to be within certain limits and there’s a cap on how much investment income you can make.

You’re eligible if:

- You earned income from a job, your own business, or certain disability benefits. Unemployment income does not count as earned income, so if you only made unemployment income in 2014, you are not eligible to claim the credit.

- You did NOT receive more than $3,350 in interest and investment income. Examples of investment income include interest, dividends, and profit from selling stocks.

- Your filing status is Single or Married Filing Jointly. If you’re Married Filing Separately, you are NOT eligible.

- You, your spouse and children, if applicable, all have Social Security numbers.

- You and your spouse can NOT claimed as a dependent or qualifying child on someone else’s return.

- You either have at least one qualifying child OR either you or your spouse are between the ages of 25 and 64.

- If you have a qualifying child, you and your spouse’s age don’t matter

- If you don’t have a qualifying child, you and your spouse’s age do matter. One of you needs to be at least age 25 but under age 65 on December 31, 2014.

- You are a citizen or resident of the United States.

There are some other rare circumstances and edge cases, but this covers the majority of situations.

What is a Qualifying Child?

A qualifying child is:

- Your son, daughter, stepchild, adopted child, or their descendant (such as a grandchild).

- Your brother, sister, stepbrother, stepsister or or their descendant.

- Your foster child, placed with you by an authorized agency or court order.

- Age 18 or younger on December 31, 2014, unless he or she is a full-time student, in which case the student must be 23 or younger. A person who is permanently and totally disabled at any time during the year qualifies, no matter how old.

- A resident with you in the United States for more than half of the year.

How Much is the Credit Worth?

The amount of the credit depends on a number of things – the amount of income you made. your marital status, and the number of qualifying children you have. See the table below for the amounts for Tax Year 2014 (for taxes filed in 2015).

|

How Do I Claim the Earned Income Credit

The only way to claim the EIC is to file a tax return, even if you do not owe any tax and are not required to file. As I mentioned earlier, the EIC is a refundable tax credit, meaning you could qualify for a refund even if you have not paid any income tax. Common Form supports the EIC, so file your taxes with us to claim this valuable credit.

Bill Hendricks is the CEO and co-founder of Common Form, which helps people with simple finances file taxes in 5 minutes from their phone or computer.