BNPL Debt Help: How to Escape Buy Now Pay Later Traps

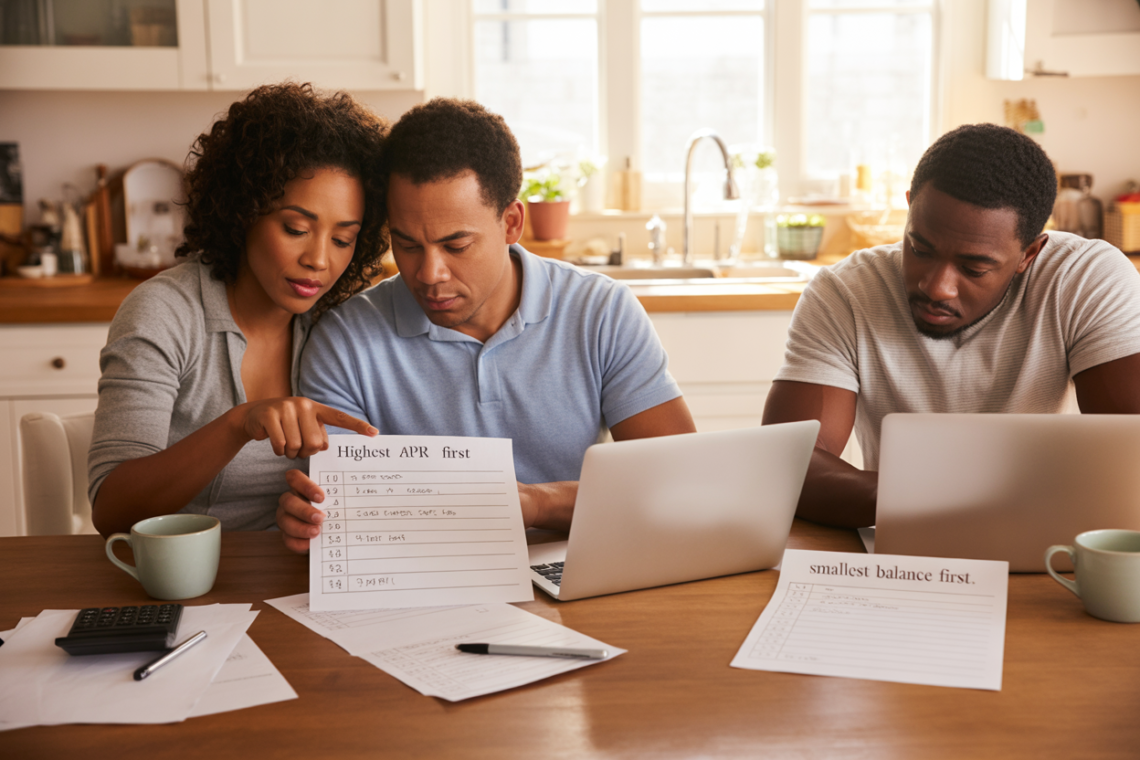

Buy now pay later debt help is about learning immediate steps and longer-term solutions when installment plans become unmanageable. This guide shows DIY fixes, professional options, and what to watch for so you can stop small missed payments turning into a bigger credit problem. You’ll learn practical next steps, negotiation scripts, and when to seek […]

BNPL Debt Help: How to Escape Buy Now Pay Later Traps Read More »