Compound Banc is a financial technology (Fintech) company that provides access to institutional-quality real estate investments and products to retail investors. They offer low-cost, tax-advantaged investments with fixed contractual returns, unlike other investment instruments where past performance is not necessarily indicative of future returns.

PRESS RELEASE

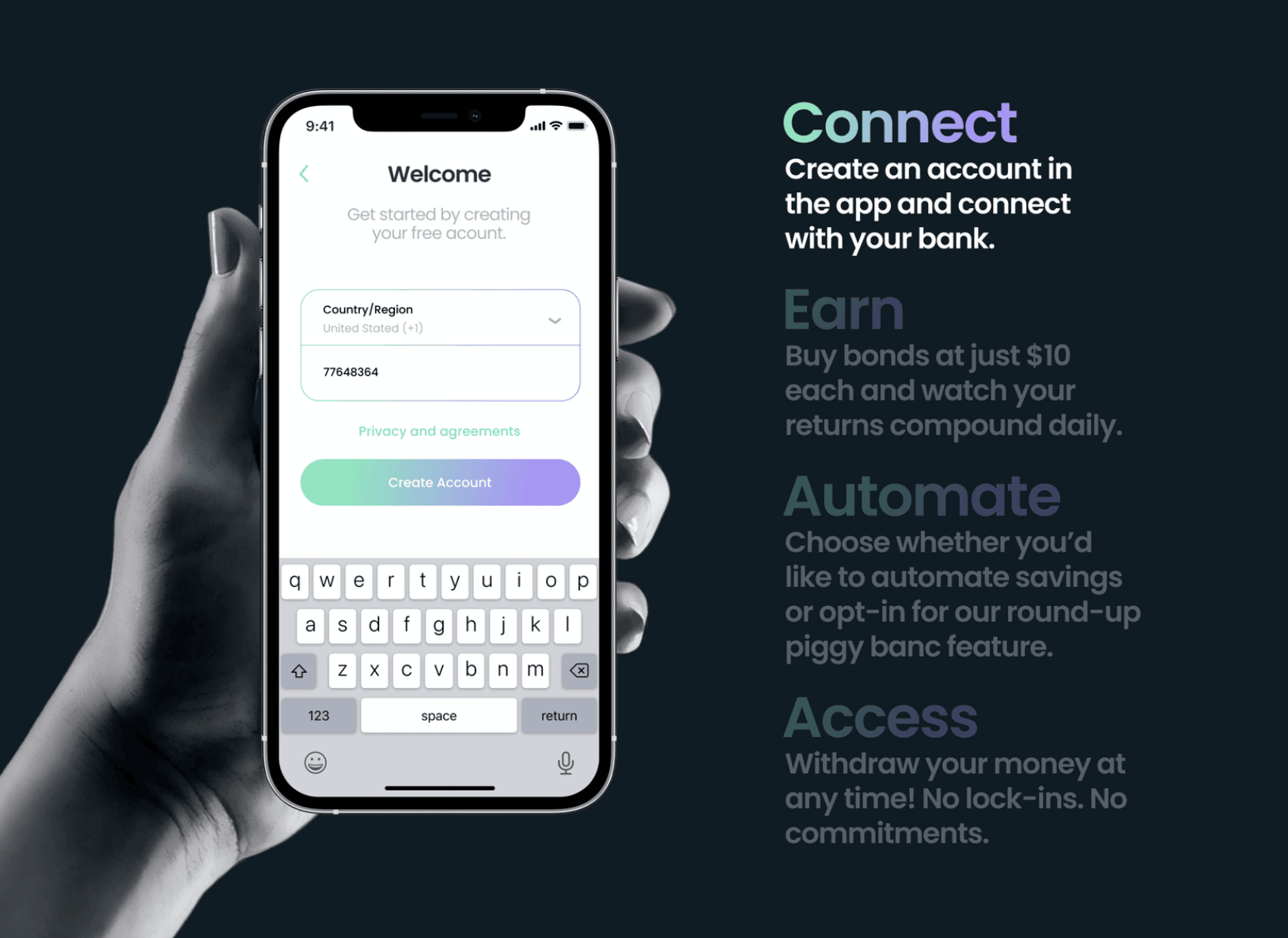

NEW YORK – February 21, 2023 – Compound Banc, a financial technology company unlocking Wall Street-caliber investment products for retail investors, today announced the public launch of its platform along with its first product, Compound Real Estate Bonds (CREB). Accredited and non accredited investors earn a fixed 7% yield on invested money with no fees, no commitments, and no minimums, all backed by high quality, cash-generating real estate assets. Investors can get started via the web-based platform or mobile app. The news comes on the heels of Regulation A qualification from the Securities and Exchange Commission for an initial public bond offering of $75 million.

Compound Banc was founded to make alternative wealth building products more accessible to retail investors, focusing only on instruments that generate consistent, dependable long-term growth. Compound Real Estate Bonds – the first real estate savings bond offering in the United States – provide an interest rate that’s 125 times the national average. Once reserved only for accredited and institutional investors, CREB investments are fully liquid – cash can be withdrawn at any time without fees or penalties.

“What we saw transpire in the retail environment over the last two years, especially in alternative asset investing, was nothing short of horrifying,” said Michael Burmi, Chief Investment Officer at Compound Banc. “The vast majority of retail investors do not have the tools, products, or technicals to beat Wall Street in the short term, but many retail financial platforms incentivize investors to try and do exactly that. We empower retail investors to use their greatest advantage over Wall Street, which is time. Compound provides institutional-quality products that help investors build substantial wealth over the long haul.”

Unlike traditional real estate investing, which requires high upfront capital, limited diversification and exposure, and low liquidity, investors can purchase Compound Bonds for as low as $10. Accredited investors have no restrictions on the amount of bonds they can purchase, while non-accredited investors can purchase bonds up to 10% of their annual income or net worth. The investments are backed by diversified real estate assets (real estate related debt, commercial, multi-family, and industrial properties) across sectors and markets with a 7% fixed APY, compounded daily.

Compound Banc offers investors a fixed contractual return, unlike other investment instruments where past performance is not necessarily indicative of future returns.

“We take a value investing strategy of acquiring assets for less than their intrinsic value and making sure fees don’t eat away at our clients’ returns,” said Yuvraj Tuli, co-founder and Chief Strategy Officer at Compound. “It’s really a fundamental of investing. Compounding interest, over time, builds wealth – especially when you can keep costs down. It may not be as thrilling as day trading huge options contracts, but that’s precisely the point.”

Compound also offers tax-advantaged accounts that allow investors to save for retirement tax free.

For more information, visit www.CompoundBanc.com or download the mobile app for iOS and Android.

About Compound Banc

Compound Banc is a next generation financial technology company, not a traditional bank. We strive to unlock financial freedom for all by building a simple, financial ecosystem that makes it possible for the everyday consumer to access assets that have historically been reserved for Wall Street, not Main Street. The firm is known for managing private real estate bond offerings to non-accredited investors. Compound Real Estate Bonds (CREB) brings private real estate exposure to the everyday investor’s portfolio without the complexity of it. CREB will invest bond proceeds in real estate debts investments and income-generating commercial real estate across key property types on a global basis. The firm is led by a team with decades of expertise in real estate and alternative asset management and indexing. Our professionals work in offices across the globe, united by a single purpose: unlocking access for everyday investors. Further information is available at www.compoundbanc.com

FAQs

How can I invest with Compound Banc?

Accredited investors have no restrictions on the amount of bonds they can purchase, while non-accredited investors can purchase bonds up to 10% of their annual income or net worth. Investors can also open a tax-advantaged account to save for retirement tax free.

Does Compound Banc have a mobile app?

Yes, Compound Banc has a mobile app available for both iOS and Android. The app allows users to easily manage and track their investments, view their portfolio performance, set up alerts and notifications, and more.

Read – 4 Apps That Tap Into Your Credit Cards Hidden Benefits