Interest Rates 2026: Mortgage Predictions & Outlook

Interest rates 2026 are one of the biggest financial topics affecting homebuyers, investors, and the broader economy. As of early March 2026, mortgage rates are

One of the biggest financial mistakes you can ever make is taking bad financial advice — or more accurately, applying financial advice the wrong way, at the wrong time, and for the wrong reason.

Following so-called “good” financial advice can actually get you into a world of economic trouble if you’re not careful. So, think about whether any of the following scenarios sound familiar when it comes to advice you might have taken — and later lived to regret.

Interest rates 2026 are one of the biggest financial topics affecting homebuyers, investors, and the broader economy. As of early March 2026, mortgage rates are

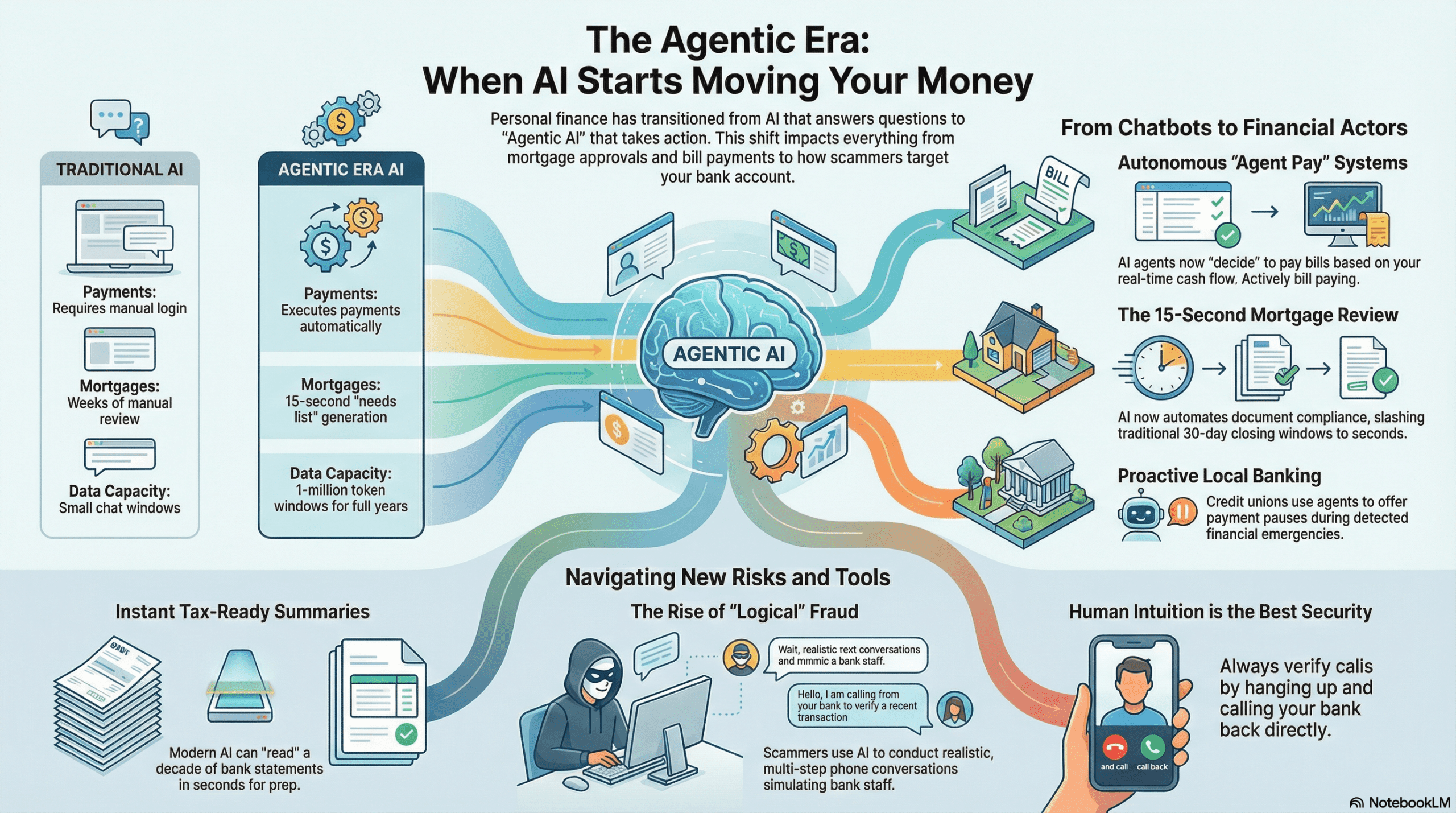

Finance trends 2026 show a major shift in how financial institutions, businesses, and individuals manage money. Artificial intelligence, real-time data, and sustainable finance strategies are

Embedded finance is reshaping how consumers and businesses access financial services. By integrating payments, lending, and banking directly into apps and platforms, users can complete

Private credit has become one of the fastest-growing areas of global finance. Companies increasingly borrow from investment funds rather than traditional banks, creating a rapidly

Hyper-personalization banking is transforming how financial institutions interact with customers by using AI, real-time analytics, and behavioral data to create tailored experiences. Unlike traditional banking,

Mortgage rates 2026 are one of the most important factors shaping the housing market this year. After several years of volatility, rates appear to be

AI SIGNAL – The AI-Finance Revolution The AI-Finance Revolution is the moment when artificial intelligence begins merging with traditional banking, changing how people spend, save,

AI SIGNAL — Issue #1 The AI Signal is your weekly, five-minute rundown on how artificial intelligence is actually changing your wallet, your work, and

What is the most important way to measure if your bank or credit union is actually helping you? Direct Answer: The single most important metric

What does Ray Dalio’s “Law of the Jungle” mean for personal wealth and Bitcoin? Direct Answer: Ray Dalio warns that the post-WWII rules-based international order

Is the traditional software-as-a-service (SaaS) subscription model being replaced by AI? Direct Answer: Yes. The arrival of autonomous AI agents is decoupling software revenue from

Direct Answer Using mathematical proofs—a process called “Formal Verification”—ensures software safety by proving that a program’s logic is fundamentally correct before it ever runs. Unlike

Direct Answer When dominant tech platforms open their ecosystems, consumer choice expands from “platform-level” choices to “service-level” choices. Instead of being forced to use every

Direct Answer The massive escalation in Distributed Denial of Service DDoS attack scales—now reaching tens of terabits per second—is forcing a shift from manual, reactive

Direct Answer The shift from software as a tool to software as a collaborator changes workforce dynamics by moving the human role from “operator” to