Why Your New Year’s Resolution Should Start on Thanksgiving Day

If you’re thinking about making a New Year’s Resolution of any kind – maybe to lose weight, pay off debt or stop a bad habit

One of the biggest financial mistakes you can ever make is taking bad financial advice — or more accurately, applying financial advice the wrong way, at the wrong time, and for the wrong reason.

Following so-called “good” financial advice can actually get you into a world of economic trouble if you’re not careful. So, think about whether any of the following scenarios sound familiar when it comes to advice you might have taken — and later lived to regret.

If you’re thinking about making a New Year’s Resolution of any kind – maybe to lose weight, pay off debt or stop a bad habit

When the hosts of the Morningstar, Inc. podcast, The Long View, asked me to discuss the wealth gap and my own financial story, they probably didn’t

Here’s the most personal essay I’ve ever written about my life and upbringing in a family that struggled economically. It’s a side of The Money

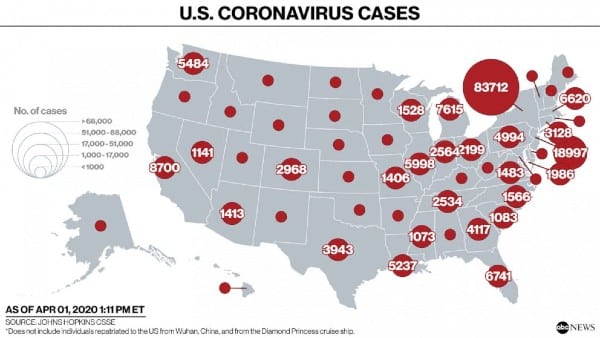

The COVID-19 outbreak is causing people to make tough choices regarding their finances. Are you in this boat? If so, you likely have to accept some unpopular truths to weather the storm of these uncertain times.

Here are some hard, but necessary financial truths that you need to consider as you move through these difficult times.

Currently, the average cost of a funeral is between $7,000 and $10,000. While life insurance can help cover some of the expenses, not every insurance plan includes burial assistance.

Like most things these days, you can make a will online. But the question really is: should you create an online will versus having a will drawn up the traditional way – by using a lawyer?

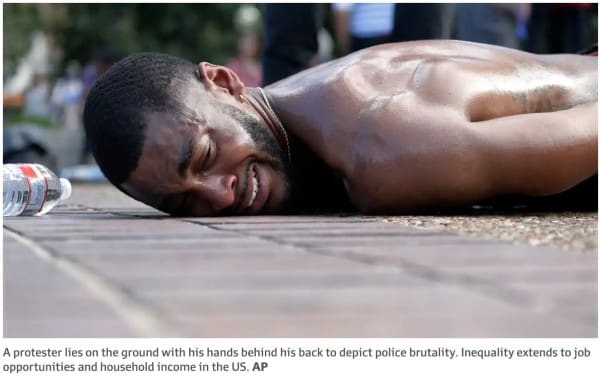

The tragic murder of George Floyd (#GeorgeFloyd) highlighted the heinous reality of racism, police brutality, and the legacy of racial violence in America. If we’re going to truly address this country’s ills, we must name, condemn and fix ECONOMIC violence too.

In this video, Lynnette shares information on available SNAP food benefits and resources to anyone that needs help.

At this time, the student loan relief plan outlined in the CARES Act does not include those who have private loans. However, some private lenders are waiving fees and offering forbearance and deferment options.

In late March, Congress passed the CARES Act; a bill meant to ease the financial hardship brought on by COVID-19. One of the provisions established a one-time Economic Impact Payment (stimulus check) for Americans. Here are answers to your frequently asked questions about stimulus checks.

COVID-19 has thrown many people into an economic tailspin. From small businesses to individuals, many are reeling from the impact this public health crisis is

Q: I have a question regarding the stimulus package. In your video, you mentioned that people who once didn’t qualify for unemployment now do through

To fight COVID-19 and the coronavirus pandemic, Congress in March 2020 passed three separate economic relief bills to help struggling individuals and businesses. The first

The COVID-19 outbreak has forced millions of Americans nationwide to apply for unemployment benefits throughout every state in the country. To offset the financial damage