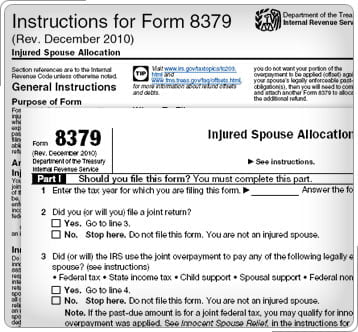

How to Claim Injured Spouse Relief from the IRS: Form 8379

Did you file a joint income tax return and expect to get a big check back from Uncle Sam only to find out that the

It hurts to get a big tax bill and find out that you owe the government. But there are some ways you can start to lower your taxes in the future.

Did you file a joint income tax return and expect to get a big check back from Uncle Sam only to find out that the

If you settled a credit card debt last year, by paying less than originally owed, the debt settlement company probably didn’t tell you this, but

]Nobody likes to pay taxes. In fact, most people prefer to get a little something back from the IRS after filing a federal tax return.

Did you go through foreclosure, modify your mortgage, or do a short sale last year and sell your home for less than what was owed

Amid the tough economy, lots of people tapped into their 401(k) retirement plans or Individual Retirement Accounts (IRAs) as a way to get cash to

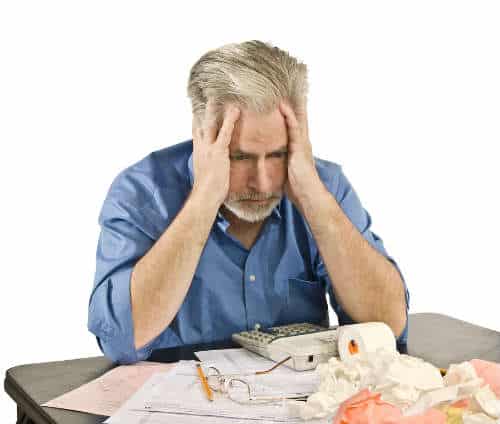

Gathering all your tax records together and figuring out whether you owe money or will collect money at tax season is stressful enough. But chances

All taxpayers want to lower their tax bills. One way to do it is by claiming tax credits to which you may be entitled. A

The IRS wants military personnel and their families to know that they can get tax help free of charge. The no-cost tax help comes courtesy

Update: This article pertains to the the 2011 tax filing season. The 2012 deadline to file your tax return is: April 17, 2012. The Internal

Q: I am going through a very acrimonious divorce and paying through the nose. I am a private practice epsychologist. I usually had no problem

Q: I Have a Property About to Be Put on Sale for Tax Delinquency in Florida. I Have Medical Debt Due to a Spinal Injury

Q: Is it true that I will be given a 1099-c when I settle a debt for $600 or more off the amount that was

Question: One of my readers wanted to know whether or not they should use their tax money to pay off all of their debt, or

Q: My understanding was that the IRS could file up to six years later. I have a small business and have been keeping my records six

Q: I want to use my tax refund money wisely this year so I can build a strong foundation for me and my two little