Paying so-called minimum payments now actually ends up costing you more – a lot more – over the long haul.

The math behind some of the calculations that determine your interest rate can be tricky.

And I won’t get into all the complex, and sometimes mind-boggling formulas that are used to calculate your Annual Percentage Rate (APR). But suffice to say that for every $1,000 you owe, if you paid a minimum of say 4%, you’d only be paying $40 a month.

With just $2,500 in debt on a card with an 18% interest rate, you’d spend 10 years paying it off and you’d pay more than $1,400 in finance charges on top of what you originally spent.

A Guaranteed Investment Return

Many charge cards carry very high interest rates of 18% to 21%, or more.

If you carry large credit card balances, that’s a drain on your monthly finances. At the very least, start doubling up on your payments in order to pay off those credit cards sooner, rather than later.

If you pay off a MasterCard that is charging you 21% interest, that’s the equivalent to earning a guaranteed 21% investment return – and you won’t find that kind of guarantee anywhere in the stock market.

But I Don’t Have the Money!

I know some of you may be saying: “I don’t have the money! If I had the money to pay three times my minimum balance – or even all of it, I would’ve done it by now!” Well, keep reading – particularly in Day 15 through Day 24 of Zero Debt– for ideas about how you’re going to come up with the money to ultimately achieve Zero Debt status.

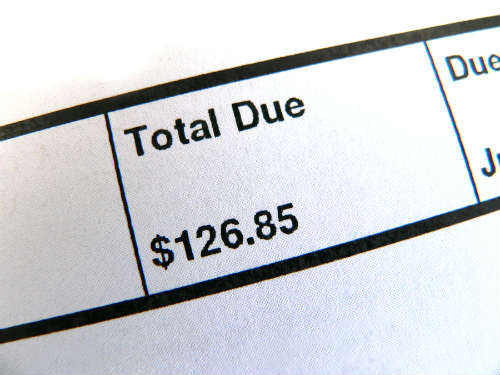

For now, to get you on track, I want you to write a check this day to pay more than the minimum due on one credit card that you owe.

I don’t care if it’s a $5 check. Just pay extra money on any one bill right now. It can be on a card you’ve already paid this month or an upcoming bill. But mail that check today!