Avoiding Payday Loan Traps: Smart Ways to Protect Your Money

Avoiding payday loan traps is one of the most important financial skills you can develop if you want to protect your income and avoid long-term

Debt is a multi trillion dollar problem in America. If you look around you, you no doubt know somebody who has debt of some kind. You probably even have debt of your own you’re looking to pay off.

Avoiding payday loan traps is one of the most important financial skills you can develop if you want to protect your income and avoid long-term

A debt consolidation guide helps you understand how to combine multiple debts into a single, more manageable payment—often with a lower interest rate. For many

The holidays are over, but if you’re like most Americans, your credit card statements are just getting started. Feeling like you went a bit overboard,

Managing variable interest rates is a critical financial skill for anyone with adjustable-rate loans, savings accounts, or mortgages tied to market changes. Because these rates

Debt payoff motivation is often the deciding factor between people who successfully become debt-free and those who give up halfway through. In 2026, rising living

A debt elimination plan is a clear, step-by-step strategy for paying off debt in a structured and realistic way. Instead of juggling balances and due

Can unemployment garnish your wages if you owe money back? In short, yes—under certain conditions, your wages or future income can be taken to repay

An AI debt payoff planner uses machine learning and automation to build a personalized path to becoming debt-free and often automates payments and tracking. In

Hard inquiry removal guide: you can only remove a hard inquiry if it resulted from identity theft, fraud, or an error — legitimate checks stay.

Medical debt negotiation tips start with one simple action: get an itemized bill and verify every charge. Using a careful, polite approach will help you

Debt-to-income ratio fix should be your first priority if high monthly obligations are blocking mortgage approval or limiting credit options. This article explains concrete steps—paying

Buy now pay later debt help is about learning immediate steps and longer-term solutions when installment plans become unmanageable. This guide shows DIY fixes, professional

Debt consolidation pros and cons are worth weighing carefully before you combine debts into a single loan or transfer balances. This article breaks down the

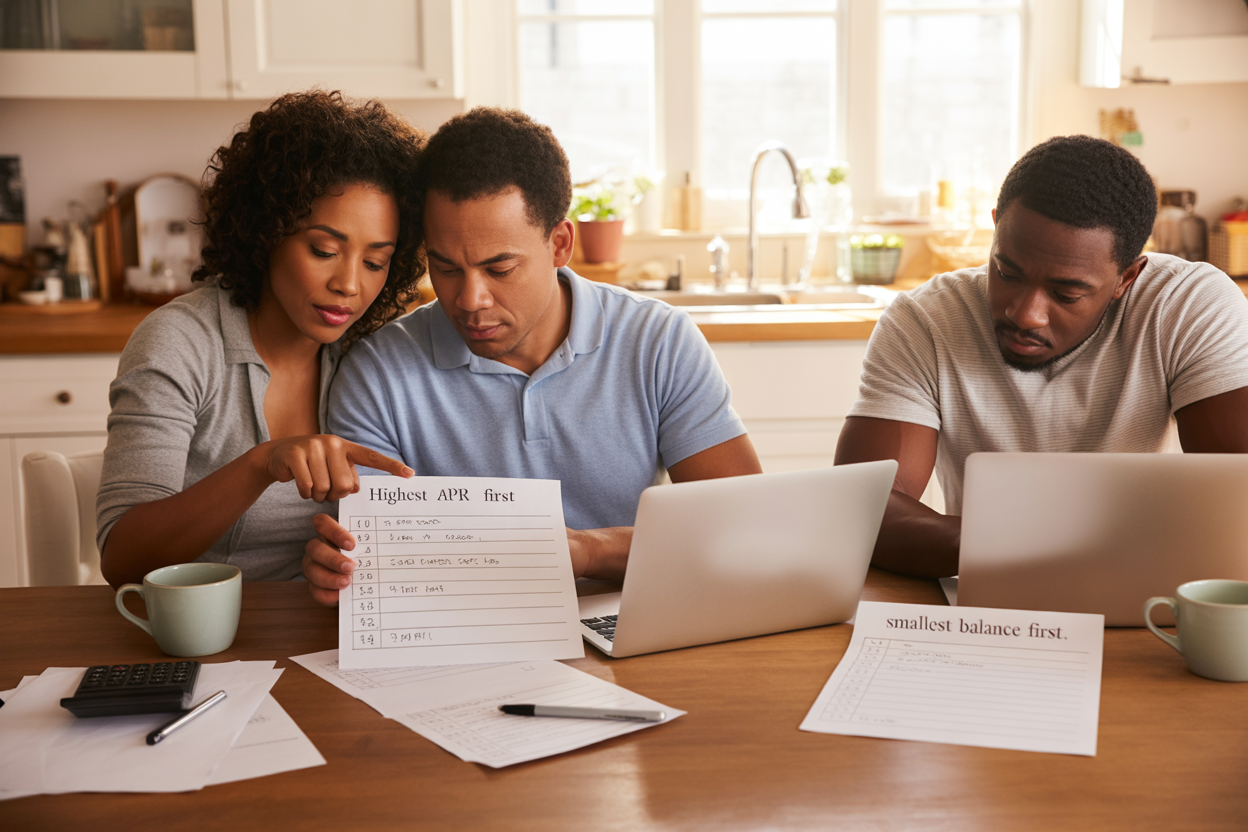

Debt avalanche vs snowball is a central debate in personal finance: one saves the most interest, the other builds quick wins to keep you motivated.

Debt settlement companies promise to reduce your debt by negotiating with your creditors, but understanding how these companies work is essential before you sign up.