Retirement Investing for Beginners: A 2026 Starter Guide

Retirement investing for beginners can feel overwhelming, but starting early is the key to building long-term wealth. In 2026, focusing on tax-advantaged accounts, smart asset

Planning for your retirement can be an exciting endeavor, but also a scary prospect if you feel financially unprepared.

So how do you know if you’re really economically ready to say goodbye to your colleagues and check out of the workforce?

Articles in this category answer many of your questions about retirement planning, saving for retirement and various retirement topics.

You will find additional articles on retirement in my column that I write for AARP.org

Retirement investing for beginners can feel overwhelming, but starting early is the key to building long-term wealth. In 2026, focusing on tax-advantaged accounts, smart asset

Cross border retirement planning is the process of coordinating your retirement savings, taxes, and benefits across more than one country. It is essential for expats,

Retirement planning for single women demands a more intentional and strategic approach than traditional retirement advice often assumes. Without spousal income or benefits to rely

Retirement party planning is about more than organizing an event—it’s about honoring a lifetime of work and celebrating the next chapter. Whether you’re planning a

A life plan retirement community is designed for older adults who want to enjoy independent living today while securing access to higher levels of care

Non profit retirement plans play a critical role in helping nonprofit organizations attract, retain, and support long-term employees. While nonprofits often operate with tighter budgets,

Retirement house plans are thoughtfully designed homes that support comfort, safety, and independence as people age. Often called empty-nester or aging-in-place plans, these designs reduce

A retirement plan consultant plays a critical role in helping businesses and individuals build compliant, sustainable retirement strategies in 2026. As regulations evolve under ERISA

Retirement planning by profession recognizes that careers differ in income structure, benefits, and retirement timelines—and so should retirement strategies. A nurse, a dentist, and a

A retirement plan lawsuit can determine whether millions of dollars meant for employees’ futures were properly protected or quietly drained by excessive fees and poor

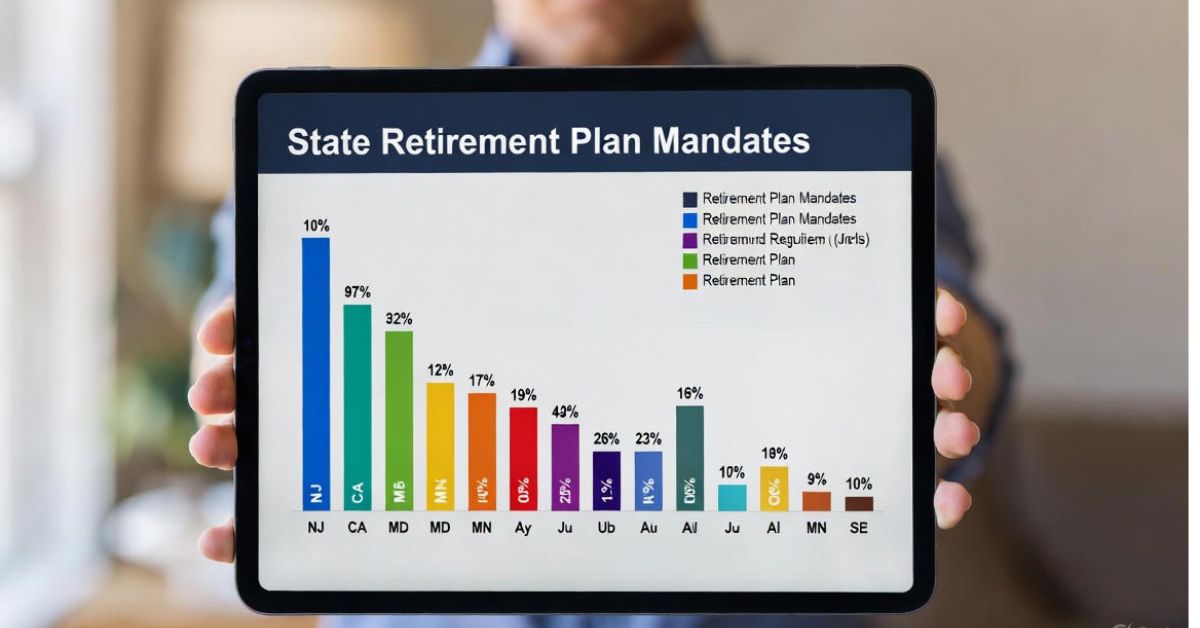

A retirement plan mandate is a state law that requires certain private employers to give workers access to a retirement savings option. These mandates are

Government retirement plans are designed to provide long-term financial security for federal, state, and local public employees. Unlike most private-sector options, these plans often combine

The teamsters retirement plan is one of the most established union pension systems in the United States, designed to provide lifetime monthly income to eligible

An employer retirement plan is one of the most powerful workplace benefits for building long-term financial security. These plans allow employees to save and invest

Retirement income planning is the process of turning your savings, investments, and benefits into dependable cash flow that lasts your entire retirement. Unlike saving for