How to Use Tax Credits for Child Care Expenses

You finally found that perfect nanny or babysitter to care for your kids. Congratulations! But the work isn’t done yet. Did you know that hiring

It hurts to get a big tax bill and find out that you owe the government. But there are some ways you can start to lower your taxes in the future.

You finally found that perfect nanny or babysitter to care for your kids. Congratulations! But the work isn’t done yet. Did you know that hiring

You’re probably somewhat stressed if you’re in the throws of finishing your federal income tax return. After all, Monday, April 15, 2013 is the tax-filing

In a previous article I explained one of the most important personal tax credits offered to U.S. taxpayers, the adoption tax credit. If you’ve recently

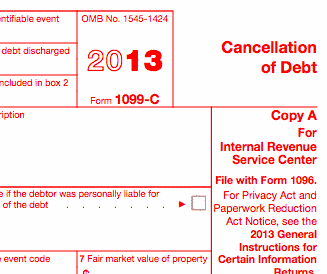

If you recently received a 1099-C, Cancellation of Debt, you may be wondering what to do with that form and how to use it when

Once again, most Americans expect to get a tax refund check, and more than a third of them plan to spend some or all of

As you get ready to file your tax return for 2012, don’t overlook many of the benefits that were ushered in when Congress passed the

If you’re one of the millions of taxpayers who owe money to the IRS this tax year, you need to make sure you’re taking

The Child Tax Credit allows you to claim up to $1,000 for each of your “qualifying” children who are under the age of 17

Q: Can I claim the child tax credit plus the child and dependent care credit? A: As long as you legally qualify for both credits,

Whenever you claim a credit on your federal income taxes, the IRS categorizes that credit as either a nonrefundable credit or a refundable tax credit.

Owing back taxes to the IRS can be a scary and stressful situation. You may have a tax levy or tax lien due to overdue

The Adoption Credit is one of the biggest refundable tax credits offered in the U.S. tax code, and it can provide those who have adopted

The Child and Dependent Care Credit became permanent starting with the 2012 tax year – giving working individuals with kids and other dependents a major

You may qualify for a mortgage interest credit if a state agency or a local government issued you a mortgage credit certificate for low-income housing.

Claiming the Earned Income Tax Credit on your 2012 taxes is a great way to lower your federal income tax bill – or even get