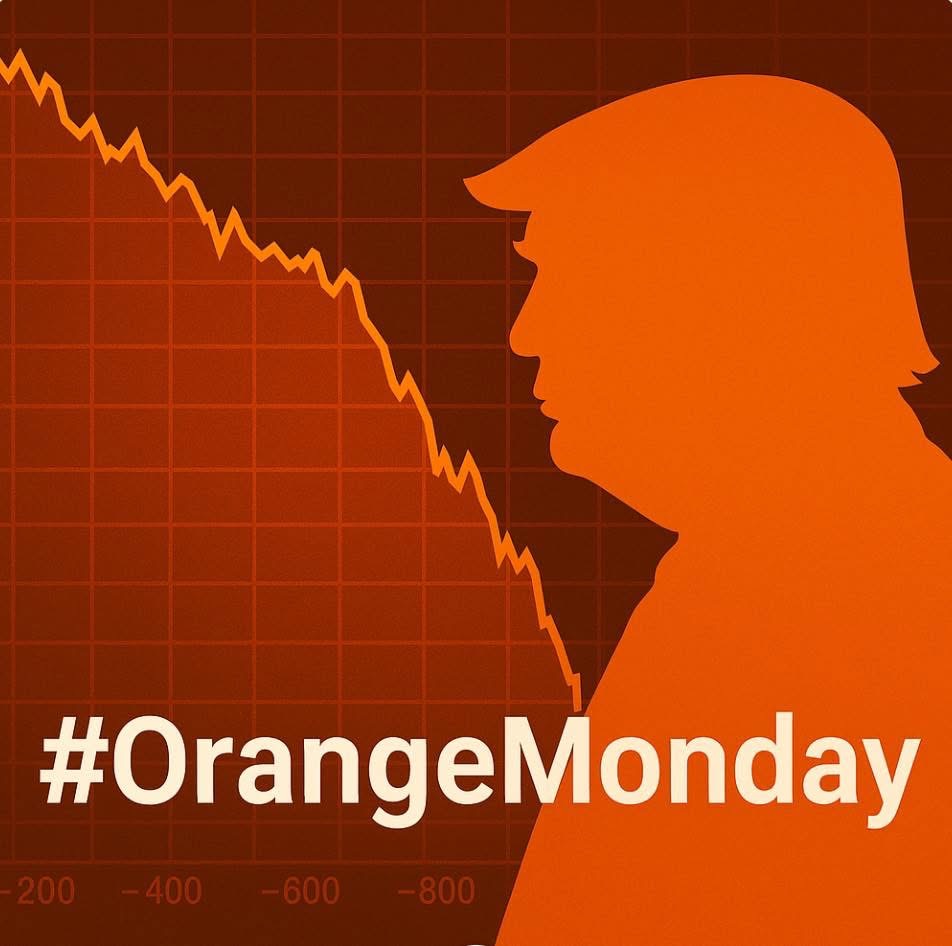

Don’t call it Black Monday. It’s Orange Monday!

Let’s be clear about what we’re witnessing today: This is NOT normal market volatility.

What we’re seeing is a global market meltdown triggered by one person’s ill-conceived economic decisions. Following huge declines across Asia and Europe, the U.S. stock market is likely to continue plunging.

Why?

Not due to natural economic cycles, but because of arbitrary tariff policies announced without sound economic analysis or careful strategic planning.

Historical market crashes have typically stemmed from structural issues, bubbles bursting, or global crises. Today’s situation under the Trump economy is different. It’s manufactured chaos from economic policies that ignore basic principles of international trade and global supply chains.

Yes, markets have always recovered eventually. But unnecessary pain is being inflicted on your retirement accounts, college funds, and financial security because the current occupant of the White House is making faulty, arbitrary and dangerous decisions affecting the global economy.

Worldwide Stock Sellfoff

After falling roughly 4,000 points in the last two trading days, the Dow Jones Industrial Average is down another 1,200+ points today as of this writing. More than $11 trillion in wealth has been wiped out since Trump took office in January, with much of the declines happening in the past week since he announced his disastrous so-called reciprocal tariffs on about 90 countries.

As a result, the economic pain caused by his tariffs (and other policies) isn’t just being felt here. It’s squeezing investors around the world too. Here’s a look at how overseas markets fared today on Orange Monday, April 7, 2025:

Hong Kong: – 13.6%

Taiwan: – 9.6%

Japan: – 9.5%

Italy: – 8.4%

Singapore – 8%

China: – 7%

Spain: – .6.4%

France: – 6.1%

UK: – 5.2%

While I normally advise staying calm during market turbulence, it’s important to recognize when volatility is natural versus when it’s artificially created. Today’s Orange Monday crash isn’t about economic fundamentals. It’s about Donald Trump’s political whims.

What to do:

1. Don’t panic, but do stay informed

2. Consider speaking with a financial advisor about protective positions

3. Remember this feeling when evaluating economic policies and your voting options

4. Understand that while markets will *eventually* recover, unnecessary volatility destroys wealth

The market doesn’t care about politics, but politics can certainly wreck the market. Under the new Trump economy, today is proof of that reality.

An Explanation of Trading Halts

Since it’s been a brutal day for stocks worldwide, let me also explain some technical things in simple terms and answer some questions:

You may have heard that “circuit breakers” got triggered in various stock markets around of the world today.

What are “circuit breakers”?

Just like electrical circuit breakers protect your home from power surges, market circuit breakers are automatic trading halts designed to prevent panic selling and give investors time to make rational decisions during extreme volatility.

How do circuit breakers work?

When a market index falls by a certain percentage (usually 7%, 13%, and 20% in the U.S.), trading is temporarily suspended. This “cooling off” period typically lasts 15 minutes for the first two thresholds, while a 20% drop would halt trading for the remainder of the day.

Do circuit breakers get tripped often?

The short answer is No. However, circuit breakers have been triggered several times, including during the 2008 financial crisis, the 2020 COVID market crash, and other periods of major uncertainty. They’ve proven effective at preventing panic-driven market collapses.

What does history teach us about these big market crashes?

Although market drops can be frightening, remember:

• Markets have recovered from every major crash in history

• Panic selling typically locks in losses

• Long-term investors who stayed the course have historically been rewarded

I wish I could say that this stock market volatility will be short-lived. Unfortunately, I can’t. No one can.

Even Federal Reserve Chairman Jerome Powell said, “We’re kind of in the same boat.” He was referencing how the Fed is watching and waiting to see Trump’s next moves before central bankers can determine the best monetary policy going forward.

Sadly, this is where we are, and Trump owns this mess.