The sallie mae student loan interest rate is one of the most searched — and misunderstood — parts of private student borrowing. Rates can look low at first glance, then climb much higher depending on credit, loan type, and repayment choices.

In this guide, you’ll learn how Sallie Mae sets its rates, why they can feel expensive, and what you can do to lower your total borrowing cost.

Key Takeaways

-

Sallie Mae interest rates vary widely based on credit, loan type, and repayment option

-

Fixed rates offer stability, while variable rates can rise over time

-

Graduate loans often have lower maximum rates than undergraduate loans

-

Auto-debit and in-school interest payments can reduce your rate

-

Comparing College Ave and refinancing options can save thousands

-

You won’t know your exact rate until you apply

What Is the Sallie Mae Student Loan Interest Rate?

The sallie mae student loan interest rate is the annual percentage rate (APR) charged on private education loans offered by Sallie Mae. These rates apply to undergraduate, graduate, and career training loans and differ significantly from federal student loan rates.

How Sallie Mae Rates Are Structured

Sallie Mae offers both fixed and variable APRs. Fixed rates stay the same for the life of the loan, while variable rates fluctuate based on market benchmarks like SOFR.

Typical Interest Rate Ranges

While rates change frequently, borrowers may see ranges similar to:

-

Undergraduate loans: ~2.89% to 17.49% APR

-

Graduate loans: ~2.89% to 14.99% APR

-

Career training loans: ~2.89% to 17.64% APR

Your final rate depends on personal financial factors, not advertised minimums.

Why Does the Sallie Mae Student Loan Interest Rate Matter?

Interest rates directly affect how much you repay over time. Even a 1% difference can add thousands of dollars to the total loan cost.

Why Is Sallie Mae Interest Rate So High for Some Borrowers?

Private lenders price risk individually. If you have limited credit history, high debt, or no cosigner, your sallie mae student loan interest rate may land near the upper range.

Federal vs Private Loan Differences

According to the U.S. Department of Education, federal student loan rates are set annually by Congress and apply equally to all borrowers. Private lenders like Sallie Mae adjust rates based on credit risk and market conditions, which explains the wide variation.

How Can You Get a Lower Sallie Mae Student Loan Interest Rate?

Lowering your rate starts before you even apply.

Step-by-Step Ways to Reduce Your Rate

-

Apply with a creditworthy cosigner

-

Choose in-school interest payments

-

Enroll in auto-debit for a 0.25% discount

-

Compare fixed vs variable carefully

-

Refinance after graduation if credit improves

Using the Sallie Mae Student Loan Interest Rate Calculator

Sallie Mae provides an online estimator that shows possible monthly payments. While not a guarantee, it helps borrowers understand how repayment options affect long-term cost.

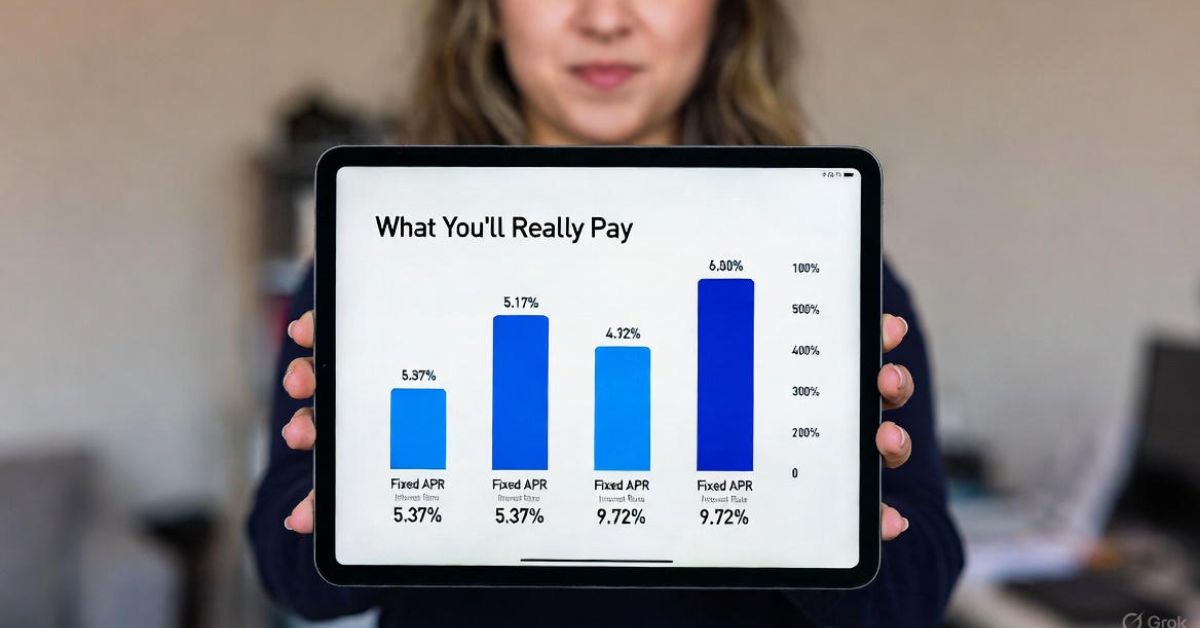

What Are Real Examples of Sallie Mae Rates vs Alternatives?

Seeing comparisons makes rate differences clearer.

Sallie Mae vs College Ave Student Loan Interest Rates

| Feature | Sallie Mae | College Ave |

|---|---|---|

| Fixed APR Range | Higher maximum | Lower cap |

| Variable APR | Can rise quickly | Often starts lower |

| Repayment Options | Flexible | Similar flexibility |

| Best For | Established credit | Rate-focused borrowers |

Many borrowers compare Sallie Mae and College Ave student loans to pressure-test affordability before committing.

Graduate Loan Rate Scenarios

The sallie mae graduate student loan interest rate is often lower than undergraduate rates due to stronger borrower profiles, but it still varies widely by program and credit history.

What Mistakes Should Borrowers Avoid?

Small missteps can dramatically increase costs.

Common Interest Rate Mistakes

-

Accepting the first offer without comparing lenders

-

Ignoring variable rate risk over long terms

-

Deferring interest without understanding capitalization

-

Skipping refinancing once income improves

Overlooking Repayment Options

The sallie mae interest repayment option you choose — deferment, fixed, or interest-only — impacts both monthly payments and total interest paid.

What Are the Long-Term Impacts of Sallie Mae Interest Rates?

Interest rates shape financial flexibility after graduation.

Total Cost Over Time

A borrower with a 14% APR could repay nearly double the original loan amount over a 15-year term compared to someone at 6%.

When Refinancing Makes Sense

Many borrowers refinance Sallie Mae loans once they build credit or stable income. The sallie mae student loan interest rate refinance path can significantly reduce monthly payments and shorten payoff timelines.

Conclusion: What Should You Do Next?

The sallie mae student loan interest rate isn’t just a number — it’s a long-term financial commitment. Understanding how rates are set, comparing alternatives like College Ave, and planning for refinancing can save you thousands.

Before accepting any private loan, review repayment options carefully, estimate total cost, and revisit your rate as your financial profile improves.

FAQs:

What is the average Sallie Mae student loan interest rate?

The average rate varies widely but often falls between mid-single digits and low double digits depending on credit and loan type.

Why does my Sallie Mae rate look higher than advertised?

Advertised rates reflect the lowest possible APR for top-tier borrowers, not the average applicant.

Can I change my Sallie Mae interest rate later?

You can’t change the original rate, but refinancing with another lender may lower it.

Are graduate student loan rates lower with Sallie Mae?

Often yes, but the sallie mae graduate student loan interest rate still depends heavily on credit history.

Does paying interest while in school really help?

Yes. Paying interest early reduces capitalization and can slightly lower your overall rate.