A retirement plan mandate is a state law that requires certain private employers to give workers access to a retirement savings option. These mandates are reshaping how small and mid-sized businesses approach employee benefits, especially in states with large uncovered workforces. In this guide, you’ll learn how retirement plan mandates work, which states are involved, and how employers can comply without adding complexity or cost.

Key Takeaways

-

A retirement plan mandate requires employers to offer retirement savings access, not to fund it.

-

Most mandates use state-run Auto-IRA programs with payroll deductions.

-

Employers can comply by offering their own 401(k), SIMPLE IRA, or PEP instead.

-

Employees are usually auto-enrolled but can opt out at any time.

-

States like California, Oregon, New Jersey, Maryland, and Minnesota have active mandates.

-

Penalties may apply for noncompliance, but setup is typically low-cost.

What Is a Retirement Plan Mandate?

A retirement plan mandate is a state-level requirement that applies to private employers who do not already offer a qualified retirement plan. Its goal is simple: expand retirement savings access to workers who would otherwise have none.

How state retirement mandates work

Under most laws, employers must either register for the state’s program or certify that they offer an existing plan. The employer’s role is mainly administrative, handling payroll deductions and employee enrollment.

Auto-IRAs as the default solution

Most states use Auto-IRAs, which are Roth IRA accounts funded with after-tax payroll deductions. These accounts are owned by employees, not employers, and are portable if a worker changes jobs.

Why Does the Retirement Plan Mandate Matter?

Retirement plan mandates exist to close a significant savings gap. According to the U.S. Department of Labor, nearly 45% of private-sector workers lack access to an employer-sponsored retirement plan.

Impact on employees

Automatic enrollment dramatically increases participation. Research cited by the Employee Benefit Research Institute shows participation rates above 70% in auto-enrollment plans, compared to under 30% when workers must opt in.

Why states are stepping in

Small businesses often cite cost and complexity as barriers to offering retirement plans. State mandates remove these barriers by shifting plan administration to state-designated providers.

How Can Employers Comply With a Retirement Plan Mandate?

Compliance is flexible, and employers usually have more than one option.

Option 1: Enroll in the state program

Employers register, add employees, and process payroll deductions. The state handles investments, recordkeeping, and support.

Option 2: Offer your own retirement plan

Businesses can bypass the state program by offering:

-

A 401(k)

-

A SIMPLE IRA

-

A SEP IRA

-

A Pooled Employer Plan (PEP)

Step-by-step compliance checklist

-

Check whether your state has a mandate.

-

Confirm your employee count and eligibility.

-

Choose the state program or a private plan.

-

Register before the deadline.

-

Maintain ongoing payroll compliance.

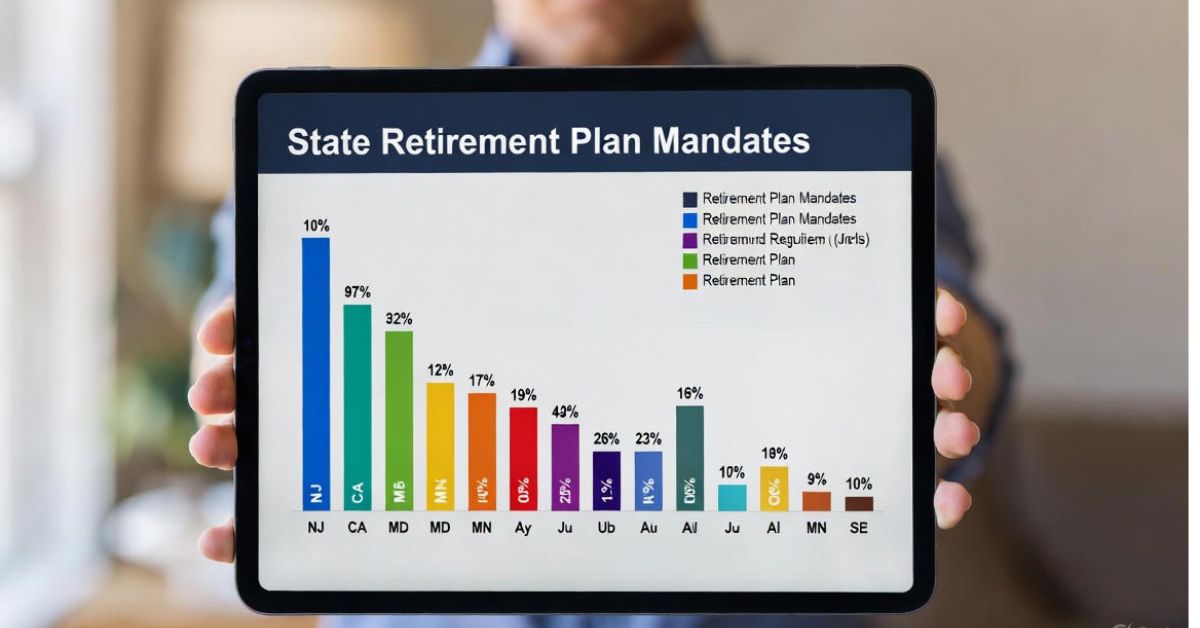

Which States Have Retirement Plan Mandates?

Several states now require employer participation, each with slightly different rules.

California private retirement plan (CalSavers)

California requires eligible employers to register for CalSavers or offer their own plan. Employees are auto-enrolled at a default contribution rate, typically 5%.

Oregon retirement plan mandate (OregonSaves)

OregonSaves was the first statewide Auto-IRA program. It applies to most private employers and uses phased enrollment deadlines.

New Jersey retirement plan mandate (NJ Secure Choice)

New Jersey mandates participation for employers with 25 or more employees who do not already offer a plan.

Maryland retirement plan mandate (Maryland$aves)

Maryland requires employers with at least one employee to comply unless exempt, making it one of the broader mandates.

MN retirement plan mandate (Minnesota Secure Choice)

Minnesota has passed legislation establishing Secure Choice, with employer registration rolling out in stages.

Comparison table: State mandates at a glance

| State | Program Name | Employer Size | Default Option |

|---|---|---|---|

| California | CalSavers | 1+ employees | Roth Auto-IRA |

| Oregon | OregonSaves | 1+ employees | Roth Auto-IRA |

| New Jersey | NJ Secure Choice | 25+ employees | Roth Auto-IRA |

| Maryland | Maryland$aves | 1+ employees | Roth Auto-IRA |

| Minnesota | Secure Choice | TBD | Roth Auto-IRA |

What Mistakes Should Employers Avoid?

Failing to understand the mandate can create unnecessary risk.

Ignoring registration deadlines

Most states impose fines for noncompliance, even if no employees choose to participate.

Assuming contributions are required

A common myth is that employers must contribute money. In almost all mandates, employer contributions are optional or not allowed.

Forgetting employee communications

Employers are responsible for notifying employees about enrollment and opt-out rights.

What Are the Long-Term Benefits of Retirement Plan Mandates?

While compliance may feel like a burden, the long-term effects are largely positive.

Benefits for employees

Workers gain an easy, consistent way to save for retirement, even at smaller firms. Accounts follow them from job to job.

Benefits for employers

Offering retirement access can improve retention, boost morale, and enhance employer branding, without the expense of traditional plans.

Broader economic impact

States aim to reduce future reliance on public assistance by increasing personal retirement savings today.

Conclusion: What Should Employers Do Next?

A retirement plan mandate is not about forcing businesses to spend more—it’s about ensuring workers have access to retirement savings. Employers should review their state’s requirements, choose the most suitable compliance option, and register early. Taking action now avoids penalties and supports long-term financial security for employees.

FAQs

What retirement plans do government employees get?

Most government employees receive pensions, such as FERS or state pension systems, often combined with defined contribution plans like the Thrift Savings Plan.

Is government pension better than 401k?

A government pension offers guaranteed income, while a 401(k) depends on contributions and market performance; which is better depends on job stability and personal goals.

What is the government equivalent of a 401k?

The Thrift Savings Plan (TSP) is the federal government’s equivalent of a 401(k).

How many years do you have to work for the federal government to get a retirement?

Federal employees are typically vested in retirement benefits after five years of creditable service.

Do state retirement mandates affect government workers?

No, retirement plan mandates apply to private employers, not federal, state, or local government agencies.