When you think about the assets you own, does your house immediately spring to mind?

It should, if you made any down payment on the house. That down payment – whether it was from funds out of your own pocket or money secured elsewhere – represents equity in your house.

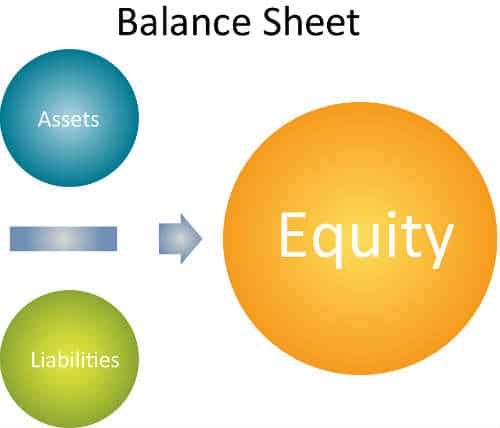

Your equity in a home is defined as the market value of the property minus any mortgages or liens on the home.

If you just bought a house worth $350,000, and you had a 10% down payment, your current mortgage balance is $315,000, which means you have $35,000 in equity in your house.

Knowing how to skillfully manage that equity – and properly maintain both your home and your finances so that you avoid financial loss or foreclosure – is part of the job of being a successful homeowner.

Why Your Home Is an “Asset” and Not a “Liability”

First, let’s take a look at why you should consider your home an asset – because not everyone views your primary residence as an asset.

Some people say a home that you occupy isn’t really an asset because a home is constantly taking money out of your pocket with mortgage payments, insurance, taxes, and so forth. For this reason, you might hear various assertions that a home is not really as asset, but a liability.

I agree with the obvious conclusion that owning a home entails ongoing out-of-pocket expenses. However, I don’t concur with the notion that just because something costs money, it doesn’t qualify as an asset.

Using that line of thinking, one could argue that the $250 sitting in your checking account isn’t an asset since having a low balance means your bank is going to charge you $5 or $10 a month for that account, or nickel-and-dime-you to death with service charges.

Although we know that getting nickel-and-dimed happens all too often, has anyone ever told you that your hard-earned cashed sitting in the bank is a “liability” instead of an “asset” simply because your checking account actually costs you money each month. That would be ludicrous, right?

It’s an Asset if You Can Sell It for Cash

Your home is, indeed, an asset for several reasons. First of all, you can sell the house whenever you choose and put cash in your pocket at closing.

(Obviously this assumes that you sell your house for more than you paid for it). In such a case, those are real dollars, not phantom profits.

The fact you’ll likely pay a real estate commission on the sale doesn’t diminish your home’s status as an asset, just like paying a commission to a stockbroker when you sell a mutual fund doesn’t negate that fund’s standing as an asset.

By the same token, it might take you one month to sell your house, whereas unloading the furniture in your house could be done in one day, at a garage sale.

In both cases, a sale is a sale and you’re still making money off the assets that buyers agree to purchase.

It’s an Asset if You Can Borrow Against It

You can also borrow against the value of your home – via home equity loans or lines of credit, attesting to the fact that all bankers consider your home an asset and will allow you to use it as collateral.

Yes, I know we’re in a credit crunch and bank lending standards are strict now. But you get the point. If your house is worth more you’re your loan (i.e. you have equity in it), then you can borrow against that house.

It’s an Asset if it Has Increased in Value or Can Increase in Value

Moreover, the home you’ve bought – or may be about to purchase – will likely appreciate in value over time, holding out the potential for a good return on your investment.

Clearly, real estate markets don’t go up every year. One need only look at home prices in 2007 through 2009 to see that.

However, homes have historically risen at a rate of 6.6% annually, according to the National Association of Realtors. This growth has represented a significant form of wealth for countless homeowners nationwide.

Meanwhile, stocks have experienced annual appreciation rates averaging 10% when you look at 10-year investment cycles for every decade going back to the 1920s.

Your Home Can Be a Great Asset, But Don’t Make It Your Primary or Your Sole Asset

When you think about your assets, you should now definitely count your home among them, just like the value of any car you own, the cash value of your life insurance policy, or any retirement money you’ve squirreled away in stocks, bonds, or mutual funds.

As with all assets, you don’t want all your wealth tied up in your home. You’ve no doubt heard the investing advice that you shouldn’t pour all your money into a single stock.

Whether you’re talking about a house or stocks, “putting all your eggs in one basket” is neither safe nor prudent in terms of diversifying your assets.

That’s one reason why, if you’re every going to tap your equity, it might be wise to utilize that equity in your home – after careful consideration and planning – for other investment purposes.

I’m not suggesting that you tap into your equity to go play the stock market or make an unwise business gamble.

But I am pointing out that for any asset you have – home equity included – you must always think about “opportunity costs,” or what you might be sacrificing by tying up your money in one investment when another, higher-paying alternative might be available elsewhere.

Excerpted from Your First Home: The Smart Way to Get It and Keep It