February is Black History Month and while we celebrate the accomplishments and achievements of many African-Americans, we also recognize that there’s so much more to do — especially economically.

In the spirit of uplifting the financial status of the Black community, here are five financial lessons from 5 great Black leaders.

- James Baldwin

As a novelist, playwright and poet, Baldwin had a way with words, including when he remarked: “Children have never been very good at listening to their elders, but they have never failed to imitate them.”

This was Baldwin’s way of teaching us: we must model good financial behavior.

Even if we think kids aren’t listening, they’re definitely watching. Young people see when we overspend. They see when we buy things on impulse or whip out a credit card. They notice when we argue about money with our partners — and more.

The good news is that kids also take note of when we save and plan; when we set financial limits and live according to a budget; or when we use our money wisely, instead of frivolously.

So by remembering Baldwin’s words of wisdom we can and should act in a way that sets a positive financial example for the next generation.

- Shirley Chisholm

A political trailblazer, Chisholm was the first African-American woman elected to Congress. She was also famous for her signature campaign slogan, which declared that she was “unbought and unbossed.”

On Capitol Hill, Chisholm was passionate about fighting poverty and discrimination, as well as protecting the environment.

Chisholm’s life’s work and her advocacy for justice is a reminder that – whether we like it or not – policy affects our pocketbooks.

So at all times – and especially in an election year – we can’t lose sight of how issues ranging from healthcare and housing to school choice and student loans will all play a role in our financial lives. It’s up to us to be advocates for the policies we believe will benefit us economically and socially.

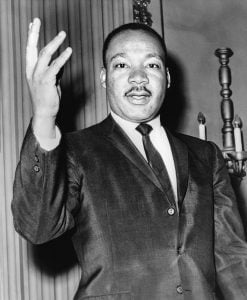

- Martin Luther King Jr.

In a July 1953 sermon, Dr. King spoke against worshipping the “false god of money.” Basically, he was urging us: Don’t put money above all else.

So many times, we say things like: “my family is everything to me” or “I would do anything for my kids,” etc. But then our actions don’t reflect that.

We spend all our time, effort and energy chasing the almighty dollar, fretting about money, or focusing on financial issues.

While Dr. King said: “Money in its proper place is a worthwhile and necessary instrument,” he also cautioned us that good health, positive relationships, and being spiritually centered are all MORE important than having a big bank account.

- Harriet Tubman

It’s well known that Tubman was a leader of the Underground Railroad movement.

But what’s less discussed is how Tubman employed the strategy of using multiple streams of income in order to reach her personal goals.

Back in the 1850s, her goal was to free her family — and then later, nearly 300 other enslaved people.

Tubman first worked as a domestic worker to save money to “buy” her relatives’ freedom. Over time, she held many jobs within the Union Army — like being a nurse, toiling as a cook, and even serving as a spy — in order to earn money. And she used substantial funds to later build and operate a home for the elderly that was located on her property in New York.

Tubman’s life serves as a great lesson for many people today who haven’t yet developed other income streams or side hustles to reach their own goals.

- Madam C.J. Walker

This innovative visionary built an empire based around doing women’s hair. She has also been credited as one of America’s first Black female millionaires – following in the footsteps of an earlier Black millionaire named Annie Malone, a businesswoman who gave Walker her start.

According to the book Black Fortunes, by Shomari Wills, in 1903, Malone owned the top Black hair care product company in the country, and she hired Walker as a sales associate. One year later, after learning the ropes from Malone, Walker started her own company selling similar products.

So we can actually learn two lessons from Walker:

a) Entrepreneurship often builds wealth; Indeed, 80% of millionaires are self-employed;

and

b) Once you learn a skill or job, or even if you can’t GET a job — due to a poor economy, lack of a degree, racism or any other factors — you can always CREATE a job of your own by offering services and products that people need.

Clearly this is what many African-American females are opting to do now.

As Entrepreneur magazine recently noted, despite a lack of funding, Black women are the fastest-growing group of entrepreneurs in America today.

So get enlightened and inspired by the examples of these 5 great Black leaders.

Each lived a life of purpose and offered the African-American community key financial lessons worth learning – and emulating – today.

Below is a clip from my appearance today on WJLA ABC 7 in Washington, D.C..