AI Signal: The AI-Finance Revolution

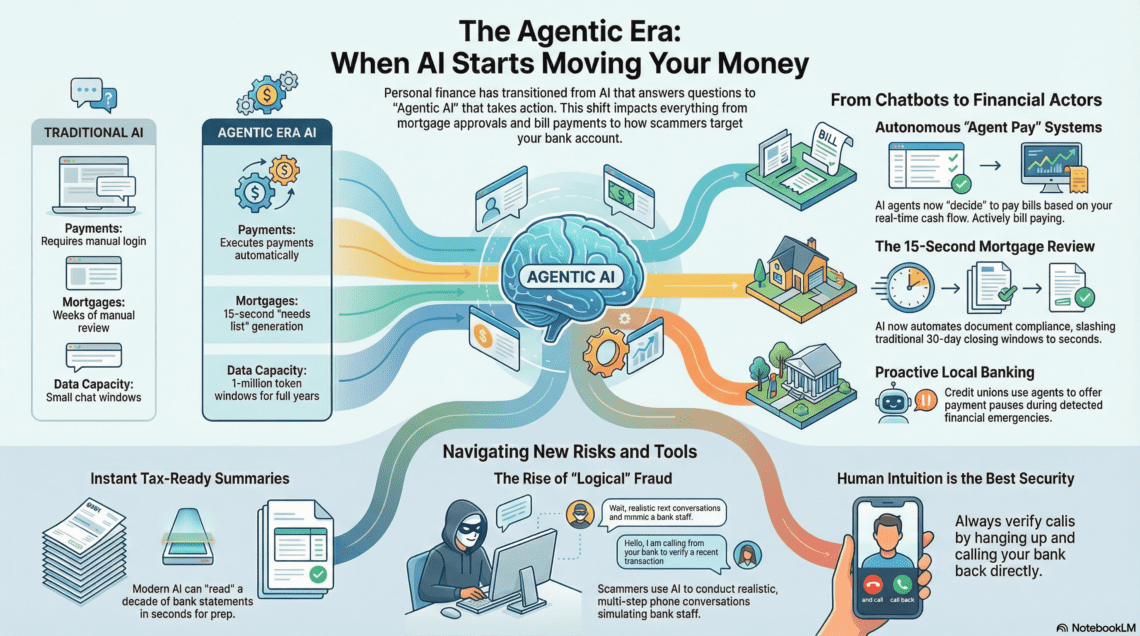

AI SIGNAL – The AI-Finance Revolution The AI-Finance Revolution is the moment when artificial intelligence begins merging with traditional banking, changing how people spend, save, and move money. The Big Signal We’re seeing a massive shift where the “traditional” banking world and the AI-driven future are finally merging. With Kraken securing direct access to the […]

AI Signal: The AI-Finance Revolution Read More »