How does turning video games into movies or TV shows change the way we tell stories?

Direct Answer Adapting video games into linear media—like film or television—forces a shift from “player agency” to “thematic depth.” In a game, the story is

Stay ahead with AI insights. Explore how artificial intelligence transforms finance, business, and personal growth through innovative tools and trends.

Direct Answer Adapting video games into linear media—like film or television—forces a shift from “player agency” to “thematic depth.” In a game, the story is

Direct Answer The rise of AI is shifting cybersecurity education from “technical execution” to “adversarial oversight.” While traditional skills like networking and manual code review

Direct Answer Integration of AI into consumer platforms shifts user expectations toward “active privacy” and “seamless interoperability.” Users increasingly expect their personal data to be

Direct Answer: Allowing AI models to write and debug their own code creates a recursive development cycle that significantly accelerates software production but introduces profound

Direct Answer Running AI agents 24/7 requires a specialized infrastructure stack consisting of high-performance GPUs or TPUs for continuous reasoning, large-scale memory for long-term “context,”

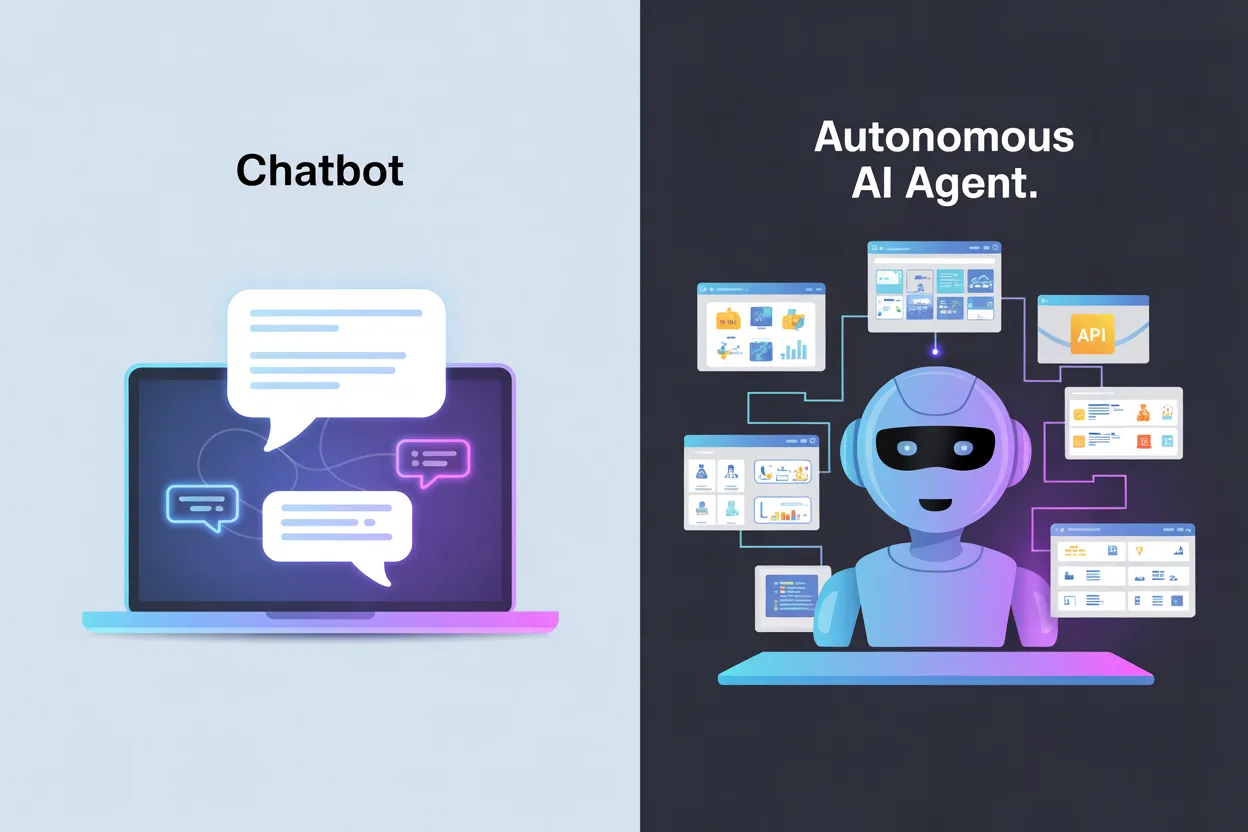

Direct Answer The primary difference between a chatbot and an autonomous AI agent lies in their operational intent and scope of action. A chatbot is

AI budgeting app are reshaping personal finance by automating expense tracking and offering personalized advice from the first login. In this guide you will learn

AI Is Helping Healthcare Businesses move faster and save money by automating admin work, improving diagnostics, and supporting patients with virtual care. This article explains

AI Phishing Scams in 2025 are changing how criminals trick people — they use generative AI to craft hyper-personalized emails, voice deepfakes, and real-looking video

Can You Trust AI To Manage Your Money is a common question as AI tools move into budgeting, investing, and fraud detection. In short: AI

AI and credit scores are revolutionizing how lenders evaluate risk and determine eligibility. By leveraging artificial intelligence, credit scoring is becoming faster, more comprehensive, and

AI in credit decision making is transforming how lenders evaluate risk and approve loans. Machine learning models now analyze far more data than traditional scoring

AI for financial coaches is reshaping the way money mentors support clients, streamline workflows, and deliver personalized strategies. As financial lives grow more complex, coaches

AI credit scoring is reshaping how lenders judge risk by using machine learning and broader data sources to produce faster, often more inclusive decisions. This

AI Budgeting Tools are changing how people and businesses track money, categorize spending, and forecast cash flow. These intelligent systems analyze transaction data, suggest budgets,