How Do Inquiries In My Credit Report Impact My Credit Score?

An inquiry in your credit file (credit inquiries) is a record of any application for credit that you made. For example, if you seek a

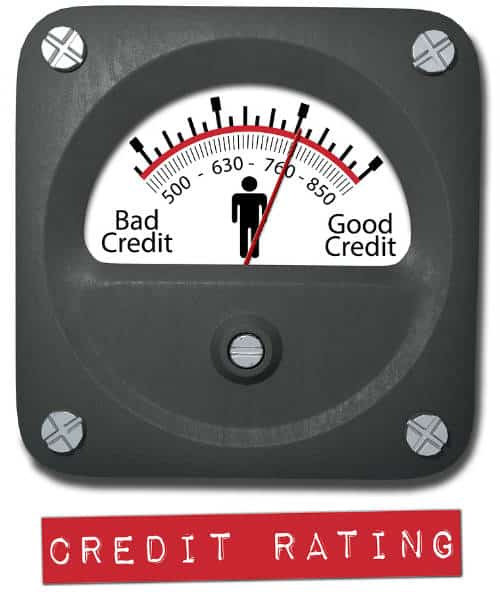

Credit scores play a huge role in your financial and personal life. Credit scores impact your ability to get a mortgage or rent an apartment, they determine whether or not you will get approved for a student loan or credit card, and your credit scores even influence the rates you pay on car insurance.

For those looking for a job, credit scores are equally important since many employers are checking job applicants’ credit ratings before determining whom to hire. The best way to stay on top of your credit health is to check your credit reports at least once a year and review your credit scores as well. The most common type of credit score is the FICO score. It ranges from 300 to 850 point. The higher your credit score, the better off you are financially.

An inquiry in your credit file (credit inquiries) is a record of any application for credit that you made. For example, if you seek a

Any “Public Records” listing in your Equifax, Experian or TransUnion credit report will seriously lower your credit scores. Although the “Account Summary” section of your

Regardless of whether you pull a credit report from Equifax, Experian or TransUnion, all credit files contain information that can be summarized into five categories:

A Facebook fan had heard that a bad credit rating could keep him from getting a job. He wanted to verify whether this is true

You probably already know that not paying a bill can adversely affect your credit score, but do you know by about how much? Do you

You hear a lot about your credit score being a strong factor behind your eligibility for credit cards, car loans or mortgages, but do you