The Consumer Financial Protection Bureau (CFPB) was developed by the U.S. Government to protect consumers against fraud and tricks from credit card companies, banks and other financial institutions. The CFPB acts as a regulator of all consumer financial service providers, which includes online banks, credit card issuers, payday loan providers and other lenders.

Today, all consumers have a wealth of resources at their fingertips at www.consumerfinance.gov. This website features videos and articles about consumer news and updates, and can help you make a more informed decision when you are shopping for financial products or thinking about taking out a loan.

What Can the Consumer Financial Protection Bureau Do?

According to the CFPB website, “the central mission of the Consumer Financial Protection Bureau (CFPB) is to make consumer financial products and services work for Americans – whether they are applying for a mortgage, choosing credit cards, or using any number of other consumer financial products.”

This organization acts as line of defense against abusive practices and also works to promote financial education and literacy among all consumers. The organization has been given the authority to supervise banks, credit unions and financial companies, and impose fines or pursue legal action if they find that certain companies and financial institutions are not complying with Federal consumer financial laws. The organization is also actively researching consumer behavior, analyzing market trends and statistics, and monitoring financial markets to detect any potential risks or problems.

How the Consumer Financial Protection Bureau was Established

Elizabeth Warren, Assistant to the President and Special Advisor to the Secretary of the Treasury has been appointed to oversee CFPB efforts, as of September 17, 2010. The CFPB was established by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 in an effort to protect U.S. consumer and regulate the consumer financial services industry. Many elements of the act will go into effect on July 21, 2011.

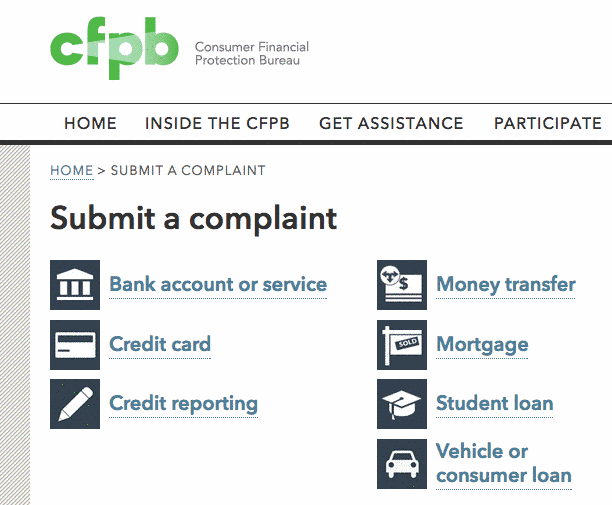

If you have questions or need to file a complaint, you can contact the CFPB directly here.