Debt avalanche vs snowball is a central debate in personal finance: one saves the most interest, the other builds quick wins to keep you motivated. This article explains how each method works, compares real-world tradeoffs, and shows how to pick the best plan for your personality and finances.

Key Takeaways

-

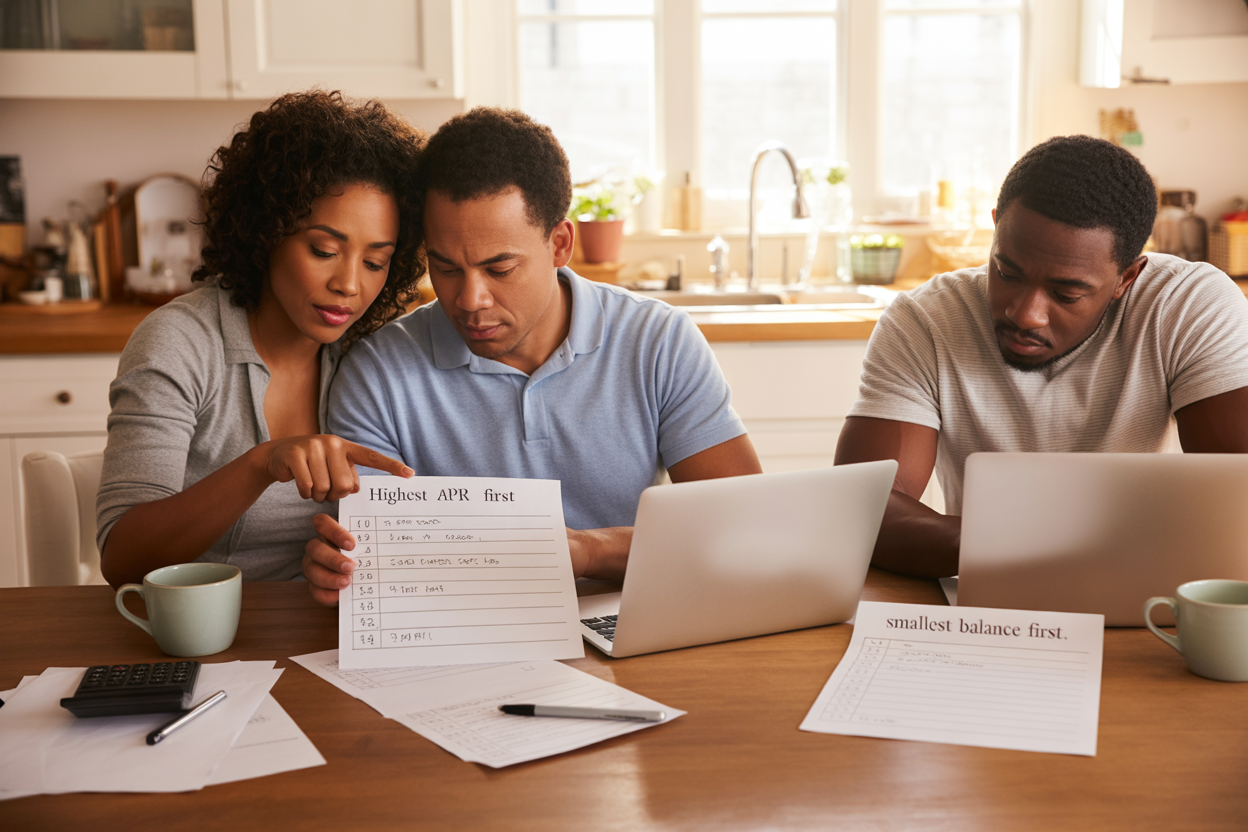

Debt avalanche vs snowball differ mainly by ordering: highest APR first vs smallest balance first.

-

Avalanche usually minimizes total interest and often shortens payoff time.

-

Snowball can increase adherence because quick wins boost motivation; research finds behavior matters for outcomes.

-

Use a debt calculator to compare exact timelines and interest saved for your debts.

-

A hybrid approach (e.g., avalanche with one small motivational payoff) can capture both benefits.

-

Choose the method you’ll follow consistently — the best method is the one you actually use.

What Is Debt avalanche vs snowball?

The phrase “Debt avalanche vs snowball” describes two structured debt payoff strategies:

Debt avalanche (what it is)

List debts by interest rate (highest to lowest). Pay minimums on all, then apply extra money to the highest-rate account until it’s gone. This reduces interest paid overall and shortens total payoff time in most numerical scenarios.

Debt snowball (what it is)

List debts by balance (smallest to largest). Pay minimums on all, then apply extra money to the smallest balance until it’s cleared. Snowball emphasizes psychology: clearing accounts quickly delivers momentum.

Why does Debt avalanche vs snowball matter?

Choosing between Debt avalanche vs snowball affects two things: how much interest you pay and how likely you are to stick with the plan. With high credit card APRs today, interest adds up fast: the CFPB and other sources report average APRs for revolving credit are well into the double digits, making interest-saving strategies important.

Short version: avalanche is mathematically superior for cost; snowball may be superior for behavior. If you stop halfway because the plan felt discouraging, the math advantage disappears—so behavior matters.

How to use Debt avalanche vs snowball (step-by-step)

Choose a method and follow these steps.

Step-by-step: Using the Debt avalanche method

-

List all debts with balances, minimum payments, and APRs.

-

Pay the minimum on every account.

-

Direct any extra payment to the debt with the highest APR.

-

When it’s paid, roll the whole payment to the next-highest APR.

-

Repeat until all debts are cleared.

Step-by-step: Using the Debt snowball method

-

List all debts with balances and minimums.

-

Pay the minimum on every account.

-

Direct extra payment to the smallest balance.

-

After payoff, roll that payment into the next-smallest balance.

-

Keep going until debt-free.

Use a debt calculator

Plug your debts into a debt calculator to see timelines, monthly payment changes, and interest saved. A calculator makes the comparison concrete and helps you decide whether the extra interest of snowball is worth the motivational gains. (Search for “debt payoff calculator” on financial sites or banks.)

When does Debt avalanche vs snowball produce big differences? (Examples & table)

Below are two simplified scenarios using fictional debts and a $300 monthly extra payment. Numbers are illustrative.

| Scenario | Debts (balances/APR) | Estimated time — Avalanche | Estimated time — Snowball | Interest saved (approx) |

|---|---|---|---|---|

| A — mixed APRs | $5,000@23% / $3,000@9% / $800@18% | 36 months | 39 months | Avalanche saves interest |

| B — similar APRs | $4,000@15% / $3,800@14% / $2,000@13% | 40 months | 41 months | Small difference |

| C — one huge low-rate & many small high-rate | $20,000@7% / five small cards@24% | Avalanche much faster | Snowball longer | Avalanche saves significantly |

When APRs differ a lot, avalanche yields the clearest benefits. When APRs are similar, the difference shrinks and behavior can be the deciding factor.

What mistakes do people make with Debt avalanche vs snowball?

-

Ignoring minimum payments — missing payments causes fees and credit harm.

-

Not recalculating after rate or balance changes — update your plan quarterly.

-

Choosing the mathematically “best” method that you won’t follow — consistency beats theoretical superiority.

-

Forgetting emergency savings — keep a small buffer to avoid pausing payoff when surprises happen.

What long-term benefits come from choosing a method?

-

Lower interest costs (avalanche) build more net worth over time.

-

Better financial habits and reduced stress (snowball) produce lasting behavior change.

-

Faster elimination of accounts simplifies finances, reduces bill clutter, and can improve credit utilization ratios — a factor in credit scoring.

Expert insight & statistic

According to the Consumer Financial Protection Bureau, the average APR on many credit card accounts has risen dramatically in recent years; the CFPB found the APR margin and interest burden increased consumer costs materially. Using an interest-first approach (avalanche) can reduce total interest paid, especially when average APRs exceed 20%.

Conclusion — Which should you choose?

If you care most about minimizing interest and can stay disciplined, choose the debt avalanche. If you need momentum and quick psychological wins to stick with a plan, choose the debt snowball. Remember: the best plan is the one you follow — consider a hybrid (avalanche for high APRs plus an early small payoff for motivation), run your numbers in a debt calculator, and commit to regular reviews.

Next steps (action checklist)

-

Gather balances, APRs, and minimums for each account.

-

Try both methods in a debt calculator and compare total interest and payoff dates.

-

Pick the method you’re most likely to follow.

-

Automate minimums, and make extra payments manual or automated to the priority debt.

-

Re-evaluate every 3 months or after any rate change.

FAQs:

How much more will I pay in interest with the snowball method?

It depends on balances and APRs; in many cases, snowball costs a modest amount more, but the difference can be large when APRs vary widely. Use a debt calculator to see exact numbers.

Can I switch between debt avalanche vs snowball mid-plan?

Yes — switching is fine. Recalculate payoff timelines and choose the approach that keeps you motivated and on track.

Should I keep an emergency fund while using either method?

Yes. A small emergency fund (even $500–$1,000) helps prevent new debt when unexpected expenses arise.

Will either method hurt my credit score?

Paying down balances and avoiding missed payments helps your score. Snowball can improve scores quickly by eliminating accounts, while avalanche reduces utilization faster when focused on high-balance, high-rate cards.

Is debt consolidation better than using avalanche or snowball?

Consolidation can be helpful if it lowers your interest or simplifies payments, but compare total cost (fees and APR) to the savings from avalanche or snowball before consolidating.