File this one under the “bad financial advice” category. An article that recently ran online from WSOCTV.com suggests that using layaway to pay for goods over time can be more expensive than credit cards.

According to the story, “consumer experts say buying on a financial plan doesn’t always make sense. Experts say a typical shopper would wind up paying far less interest using a credit card.”

Come again?

The article contends that fees can make layaway more expensive than credit cards. The writer gives an example of a shopper who wants to buy $100 worth of toys on layaway and who has to pay a $5 layaway service fee.

According to this article, a consumer might have to pay 10% down or $10, and then take two months to pay off the $90 balance.

The article states: “That $5 service fee is interest for a $90 loan. That’s the equivalent of a credit card with a 44% annual percentage rate, a level considered predatory.”

And that’s not all. U.S. Sen. Charles Schumer is also warning about layaway’s costs. He says a person buying a rock ‘n roll Elmo doll for the holidays who pays a $5 layaway service fee is paying the equivalent of a credit card with more than 100% interest.

No, no, no, no!

This is wrong on so many levels that I almost don’t even know where to begin.

Layaway Is Not a Loan

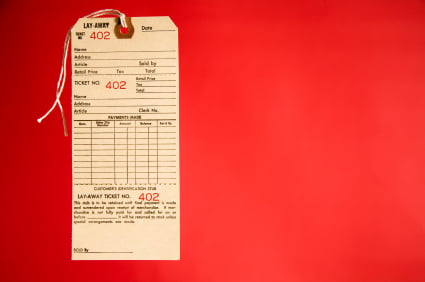

First of all, what is layaway? If you have a $90 balance for a layaway purchase, that is not a loan or even a form of credit, in any way, shape or fashion. A loan is when you receive borrowed funds from someone or some institution – as in a bank loan, a personal loan, a home equity loan, etc.

With a loan, upfront money comes in the door to you.

Another form of a loan, of course, is credit – which might be extended to you allowing you to receive merchandise upfront. Let’s assume that instead of using layaway, that same consumer went to the store with a credit card and bought those same $100 worth of toys. The customer would get the same toys immediately, and not have to wait to get them two months down the line.

Even though the person isn’t paying his or her credit card balance immediately – and, in fact, may take several months to pay off the bill – they’ve nevertheless received the toys upfront, so credit has been extended to the individual paying with a credit card.

This is not at all the case with layaway; therefore the $90 balance on a layaway plan, or any balance from layaway, is neither a loan nor credit. If it was, it would have the potential ability to impact your credit. However, it does neither. Layaway neither helps nor hurts your credit rating. (I could argue, though, that to the extent that layaway keeps you from using credit cards, it does help your credit).

Layaway is Cheaper Because Credit Cards are Open Ended

Additionally, the author of this story (and Senator Schumer) both fail to recognize that a layaway plan is not an open ended in nature, versus a credit card, which is open ended. What I mean by this is that with a credit card, you could take three months, six months, nine months, two years, 10 years, or practically any length of time you’d like to pay off your complete credit card balance.

Yes, you have to make minimum payments (in order to meet creditor requirements and not get a ding on your credit report). But it’s also the case that the average credit card issuer only requires a person to pay 2% to 4% of the outstanding balance on a credit card. That’s why for the average U.S. household, which carries about $10,000 in credit card debt, it can take more than 20 years to pay off that balance, assuming an interest rate of about 15%.

However, with a layaway plan, you’re going to have a couple of months to pay a balance; in this example, exactly two months. So the open-ended nature of a credit card means that by definition, you are guaranteed to pay interest if you pay a balance over time. (One exception might be if you charge with credit card that has a teaser rate of 0% or something like that).

But all in all, credit card balances not paid in full by the due date rack up interest charges. That’s not the case for a fixed term agreement like layaway.

Layaway Customers Don’t Usually “Roll Over” Balances Due

It’s also completely off base to suggest that the $90 layaway balance is like the equivalent of paying a credit card with a 44% interest rate, or in the Schumer example, a 100% interest rate.

A closer comparison, though not a perfect one, would be to compare a credit card interest rate with perhaps a payday loan.

I’m not suggesting that credit cards have sky-high annualized rates as do payday loans. I’m referring to the length of time that one can take to pay off credit cards and payday loans – along with the ability consumers have to “roll over” their debts from month to month, making both forms of credit/loans more expensive.

If you have, for example, a two-month balance to pay off that layaway plan, you’re not going to be able to “roll it over” or extend the balance in the way you could with either a payday loan or a credit card purchase.

One reason payday loan rates are so exorbitant, and are in fact predatory, is because people are originally scheduled to pay them back within, say, a two-week period or perhaps as long as a month. But the fact of the matter is, most people don’t do this. Instead, they “roll over” payday loans. When someone rolls over a payday loan they essentially take out a new loan to cover the old one, adding to their debt load.

And then, on an annualized percentage rate, those payday loans start to cost anywhere from 300% to 400% or more. That simply does not happen with layaway plans. Even if you didn’t pay your balance within two months, you’re not going to be financially penalized each week or each month you fail to pay.

Alternatives to Payday Loans When You Need Cash Fast

When was the last time you saw somebody roll over a layaway offering? And when is the last time you saw somebody who had layaway from last year still have it on layaway this year? But that is often the case with credit card debt and payday loans. So to compare the supposed APR on credit cards and layaway is completely wrong.

Layaway Late Payments Don’t Hurt Your Credit and Increase Your Interest Rates

And finally, that WSOCTV.com article neglects to note some important facts about those who pay late, those who don’t pay at all, or those who take longer than expected to pay when it comes to layaway versus credit cards.

If you have a late payment on your credit card for those holiday gifts you’ve charged, you can expect to rack up a late payment fee of $35 to $40 or more. You should add that fee into the cost of your annual percentage rate and figure out the true APR.

Additionally, if you are 30 days late paying your credit card, your interest rate can be increased and you can hurt credit rating. A late payment on your credit reports would, in turn, increase your overall cost of credit for other loans you may need.

By contrast, if you’re late paying your layaway, the worst that is likely to happen is that the inventory gets returned to the shelves, and you may get hit with a modest return-to-stock fee. In some instances, it is possible that you might lose a portion or all of the money that you’ve put down for layaway. That’s a real economic risk. And that’s why I do agree with Sen. Schumer that all layaway fees should be clearly disclosed.

This is why I tell consumers that you should ask eight important questions before considering layaway. Is layaway the end all to be all, and is it the perfect magic solution for shoppers on a budget? No, not necessarily.

But I can tell you this. When it come to saving money, sticking to a budget, and making sure you don’t rack up credit card debt and extra finance charges, layaway is generally way better than using credit cards.