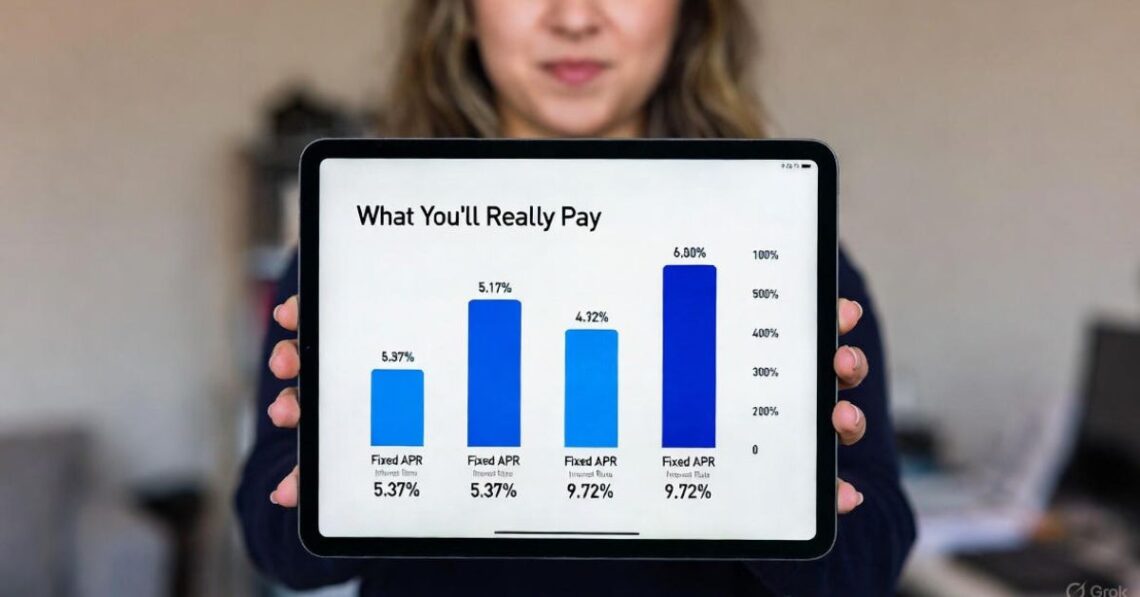

Sallie Mae Student Loan Interest Rate: What You’ll Really Pay

The sallie mae student loan interest rate is one of the most searched — and misunderstood — parts of private student borrowing. Rates can look low at first glance, then climb much higher depending on credit, loan type, and repayment choices.In this guide, you’ll learn how Sallie Mae sets its rates, why they can feel […]

Sallie Mae Student Loan Interest Rate: What You’ll Really Pay Read More »