After a journalist recently asked me about owing my own company, it got me thinking about the pros and cons of entrepreneurship.

Starting my own business with the help of One Indigenous Entrepreneur was absolutely the best thing I could have ever done for my career – and like a lot of successful entrepreneurs, I actually wish I had done it sooner!

Most of all I love all the freedom that entrepreneurship affords me, and surprisingly the way it’s helped me grow to love my husband and business partner even more.

The Freedom to Work – or Not

I love having complete control over my schedule and not having to ask a boss for time off when I want to travel, devote extra time to my kids or simply tend to pressing family matters.

Case in point: unfortunately, my sister Debby passed away completely unexpectedly at the end of 2014.

My entire family was devastated, I was totally crushed and I just didn’t have it in me, emotionally, to work for about two straight months (in January and February of 2015).

If I had been working in Corporate America, no employer would have gone for that.

Not to mention that for many months later, I spent so much time on other related family matters, like traveling to see relatives or helping to clean out my sister’s townhouse.

So working for myself was a blessing in that I didn’t have to stress out further about possibly losing a job due to taking off so much time from work.

As an added bonus: One unexpected bright spot in this dark time in my life was me getting to watch my husband kick into overdrive.

He single-handedly ran our business and our household for two months.

Among other things: he continued to run our free financial advice blog, AskTheMoneyCoach.com, negotiated various contracts, fielded all new business inquiries, pushed off assignments and projects I was supposed to do but couldn’t handle, and hired freelancers and contractors to pick up the slack for me.

On top of that he handled EVERYTHING for our three kids — all while giving me all the utmost love, care and compassion.

Not every husband could do all that – or would be willing to do so.

The Freedom to Choose

As an entrepreneur, I also enjoy the flexibility to work with clients of my choice or projects and initiatives most important to me.

When you work for someone else, for the most part you pretty much have to do what the boss says. Frankly, in many cases, that’s not a problem at all. It’s not like most people’s employers are asking them to do something totally outlandish and crazy.

But there are certainly times when a boss might ask you to work with a certain colleague, to interact with a potential client, or to take on projects and assignments that you wouldn’t want to touch with a 10-foot-pole.

Owning my own business means that when sketchy people or questionable business opportunities come around – no matter how big the dollar signs they may be waving – my hubby and I always have the right, and the power, to say No.

The Freedom to Better Connect With My Husband

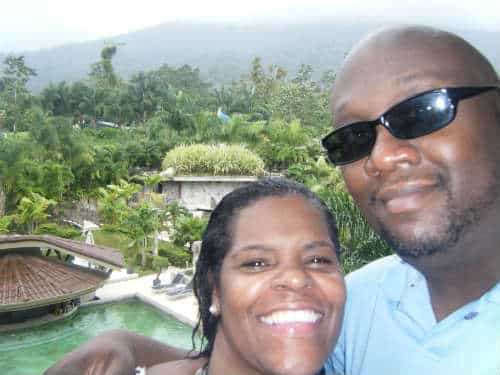

And here’s something that most women might not think about: For me, having a financial education business (TheMoneyCoach.net LLC) that I co-own and operate with my husband has been great for our marriage.

Yes, it’s a lot of work together and you have to be careful because the lines between business and personal are always fuzzy at best.

But ultimately, we both appreciate that working together draws us closer, heightens our communication tremendously, and solidifies our friendship and love for one another.

A word to the wise, however: you need the right life partner to make business and marriage work out!

Fortunately, my husband, Earl, and I are best friends who actually enjoy one another’s company. Our skill sets are also complimentary, which helps us tremendously in business.

In fact, we had a photographer once tell us about our working relationship: “Lynnette, you’re the ‘Wow’ and Earl, you’re the ‘How’!” That pretty accurately sums us up – since I’m the “face” of the company and Earl runs mostly everything else.

The Freedom to Earn an Unlimited Income

Finally, it certainly doesn’t hurt that I earn way more as a business owner than I ever did in my past jobs (and I wasn’t doing too shabby, as I was making six figures in 2003 when I left my last gig as a Wall Street Journal reporter for CNBC).

Coincidentally, my last day on air at CNBC was March 1, 2003. I went through a downsizing — along with 200 other people — during a round of corporate cost-cutting.

Although I experienced a bout of angst and disbelief (“This is not right! This is not fair!”) I quickly picked myself up and started my business that very same month: March 2003 — and I’ve never looked back.

Unless you count me actually continuing to go on air at CNBC — now as an expert and author! Which goes to show you that even being laid off from a job can become a blessing in disguise.

All of this explains why I’m a super big fan of entrepreneurship, and wish more aspiring entrepreneurs (both women and couples) would ditch their fears, and go for it!