Sometimes, one easy phone call is all it takes to get the interest rate on a credit card lowered.

However, many people are reluctant to make that call, because they mistakenly believe that creditors won’t be willing to negotiate.

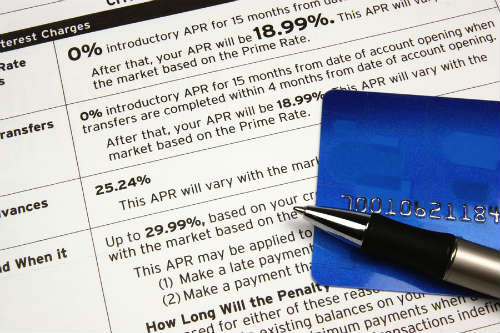

Even amid the credit crunch, however, banks and other credit card issuers are willing to consider your requests – for everything from getting a lower rate, to having late fees eliminated, to waiving over-the-limit charges.

Your chances are better, of course, if you have a solid track record of paying your credit card bill on time, as well as a good credit rating overall.

But even if your credit record isn’t pristine, here are some tips that can help anyone looking to negotiate with a credit card company.

14 Negotiating Strategies To Use With Your Creditors

If you find yourself calling your creditors for any reason to negotiate the terms of your credit cards, here are some time-tested strategies you should use:

- Call in the morning

Don’t call at the end of the day when customer service representatives are tired, more stressed and have been dealing all day with irate cardholders. Also avoid calling on the weekends; there may not be a supervisor there if you need one.

- Be polite in making any requests

Get the conversation off to a good start by using good manners. Say “hello” or “good morning” to the person you’re talking to and call her by name, as in “Good morning, Susan, this is Kim Jones, I’m calling about my account.” Make sure your tone sounds like you are making requests, not demands. Be friendly and conversational, not adversarial, to establish a good rapport and get the cooperation of the person on the other end of telephone.

- Request to speak to a supervisor if necessary

If you get nowhere with the person you’re talking to, don’t be afraid to “escalate” your phone call by asking to speak with a supervisor. Even if the conversation isn’t confrontational or negative, you may require a manager because some employees will say they don’t have the power to honor your request.

- Point out your length of time as a customer

For those of you who’ve been with a credit card company for a number of years, use your long-term status as leverage in asking for what you want. This can really work in your favor because most banks value loyal, long-term customers; they don’t want to lose them.

- Emphasize how much business you’ve done

Many of you might have racked up a lot of charges over time. If you’ve been a valued customer by virtue of having charged many goods and services, make that known. And state that you also value the relationship with your creditor and would like to remain a customer in good standing.

- Stress your willingness pay what you owe

Creditors may not be inclined to be flexible with individuals they perceive as trying to “get over.” The worst thing you can do is to convey the impression that you’re a “deadbeat” who is out to weasel out of paying your obligations. A better strategy: stress that you are, in fact, willing and desirous of paying your bills.

- Reveal any extenuating circumstances

In cases where there have been out of the ordinary circumstances, let your creditors know this. For instance, if you lost your job, suffered a death in the family or something major happened in your life that caused you to miss a payment, tell them. Also make it clear if something happened that prevented you from getting your bills, such as you moved addresses or got divorced and your ex-got the statements. Creditors may be willing to waive late fees in such cases.

- Directly refer to your credit report

Don’t be ashamed to say that a negative mark from the creditor could hurt your credit report – especially if you’re in the market for a new car or house. Tell them your situation, and say something like, “I’d hate for this one blemish from your company to damage my credit standing or my ability to get a loan.” Tip: only do this with your original creditors, who will likely be more sensitive to your predicament. Don’t try this tactic with collection agents. That’s giving them too much information, and they’ll just turn that information against you, saying, in effect: “If you don’t pay up, you won’t get that new house.”

- Make “first-time” cases work in your favor

If you’ve never been late before or you’ve never had an over-the limit fee assessed, ask directly for a removal of a late fee or over-the-limit charge. A little-known fact is that most credit card companies give their employees the authority (without even getting a supervisor’s approval) of waiving late fees once every 12 months. If this is the case for you, do ask to get those fees removed. You might be surprised at how easily they will agree.

- Mention their competition

As a last resort, when you’re negotiating for a lower interest rate mention that you might be inclined to take your business elsewhere. The point here is not to make an idle threat. And I wouldn’t start the conversation off with talk about you possibly going to a competitor. But you’d certainly be justified in exploring your options – and telling the creditor about other companies’ balance transfer deals or lower interest-rate offers – if they won’t budge on high interest rate cards.

- Document all conversations in writing

In the event you have to go back and get something corrected, or removed, it helps your case if you can refer to your written notes and say, “I spoke to XYZ person on this date, and was told such and such.”

- Initiate requests immediately

Anytime you see there’s an issue you want resolved, contact your creditor immediately. Don’t wait a couple weeks, or even worse, a few months to ask for a rate reduction or removal of late fees. That works against you because it seems like you didn’t care enough about the situation to do take instant action. It also reflects well on you when you initiate the call regarding late payments, as opposed to them having to contact you.

- Explain online payment discrepancies

If you were paying a bill online and for some reason payment didn’t go through, that could be a legitimate reason for late fees to get removed. Another possibility: say you were making minimum payments on a credit card that had a teaser rate of 0% interest for six months. And assume you were paying $100 a month on that card via automatic online payments.

Six months later, your teaser rate expired and the normal 14.9% rate kicked in. All of a sudden, your new minimum payment might be $115 a month. If you weren’t keeping up with things, you would still be automatically sending in $100 payments online. The first time that happened, you’d likely get dinged with a late payment, for being $15 short in your payment. If you call the credit card company and point this out to them, they’ll see your online payment history and will likely waive the late fee.

- Use the 6-month rule

Lastly, if all these efforts fail, you can always ask for a review of your account again in a few months. For example, if your request for a lower rate is denied, ask a supervisor if he or she would be willing to reconsider their position in, say, three or six months. If they agree, document the person’s name, and put a reminder on your calendar to call back at the appropriate time. And here’s some good news:

If your interest rate was high because you made a late payment in the past, some relief is on the way. That’s because in May 2009, President Obama signed into law the Credit Card Accountability, Responsibility and Disclosure Act, also known as the Credit CARD Reform Act.

One provision of the law, effective as of Feb. 22, 2010, imposes limits on how long banks can slap you with so-called “default rates” (i.e. higher interest rates) after you’ve been late paying a bill. Under the law, default rates can only be charged for six months, provided you pay your credit card bill on time during that period. After six months, your credit card issuer must restore your rate to its previous level.

So don’t fall into the trap of thinking that you don’t have leverage in negotiating with your creditors. Follow these tips and you should be fine when trying to wring lower interest rates and other concessions out of your creditors.

A Reader’s Question

Q: If you were to hit a high default interest rate on a 0% interest intro credit card; will it place a negative mark down on your credit report?

A: If I understand your question, you had a credit card with a teaser rate of 0%, but then were late on a payment and it went to a default rate.

Those default interest rates typically range from 25% to 30% or so.

Even though you were late on your payment, it will not necessarily be reported to the credit bureaus. It depends on how late the payment was received.

Banks and credit card issuers can legally report your delinquency if it is 30 days or more late.

But if you were just a day or two late, or even a week or two, that will not show up on your credit reports.