If you asked most financial planners and advisors about what goes into a budget, chances are they would tell you that a budget is broken down into certain categories.

Some advisors suggest allocating everything into two camps: necessities and luxuries.

Other advisors tell you to break your expenses down into fixed costs and variable costs.

I don’t think there’s anything wrong with either of these suggestions – other than the fact that they won’t help you become a millionaire.

Yes, it’s vital to know what items in your budget are fixed as opposed to which can vary monthly. And yes, it’s important to evaluate those items you’re spending money on that are luxuries versus those that are necessities.

So why do I say that traditional budget-making recommendations don’t work to create millionaires? It’s because they’re full of restrictions that most people find depressing – or at the very least, uninspiring.

That’s a major reason why budgets don’t work.

People don’t stick to them because they’re not motivated to stick to them.

Another reason many individuals have a tough time living with their budget is that they’ve created a budget that is completely wrong for them.

A better strategy is to create such an awesome budget you won’t want to sway from it.

Let’s develop a millionaire’s budget. It’s an empowering budget. It doesn’t put you on a fiscal diet. On the contrary, you get to spend your money anyway you choose.

Love to shop and look like a million bucks? No problem. You can include a shopping allowance in your budget – or anything else you choose – so long as your overall spending decisions adhere to two rules:

1) You can not spend more than you actually earn.

2) You should spend money on the things you want to spend it on – not just things you have to pay for.

Sound good so far? OK, stay with me. It gets better. You know why millionaires seem to have it so good?

It’s because most of them actually enjoy their money and what it can do for them. So here’s my suggestion: don’t wait until you actually are a millionaire on paper.

Start practicing the smart habits of millionaires today!a

This means creating a “Millionaire in Training” budget that is of your own choosing, gives you control over your finances, and that contains things that you enjoy spending money on.

How can you do this? By making sure your millionaire’s budget is comprised of three parts: 1) Necessities; 2) things that are truly important to you; and 3) things that give you real joy. Let’s look closer at each of these areas…

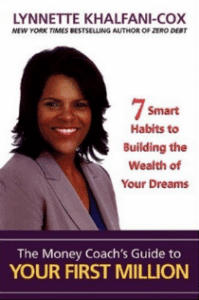

Excerpt from The Money Coach’s Guide To Your First Million now in paperback