List of Categories Found on AskTheMoneyCoach

All

AI

Bankruptcy

Blockchain

Books

Bounce Back

Budget Friendly Travel

Budgeting

Building Wealth

Business

Careers

Couples and Money

Covid-19

Credit Cards

Credit Reports

Credit Scores

Crypto

Debt

Entrepreneurship

Family Finances

Featured

Free Calculators

Health is Wealth

Identity Theft

Insurance

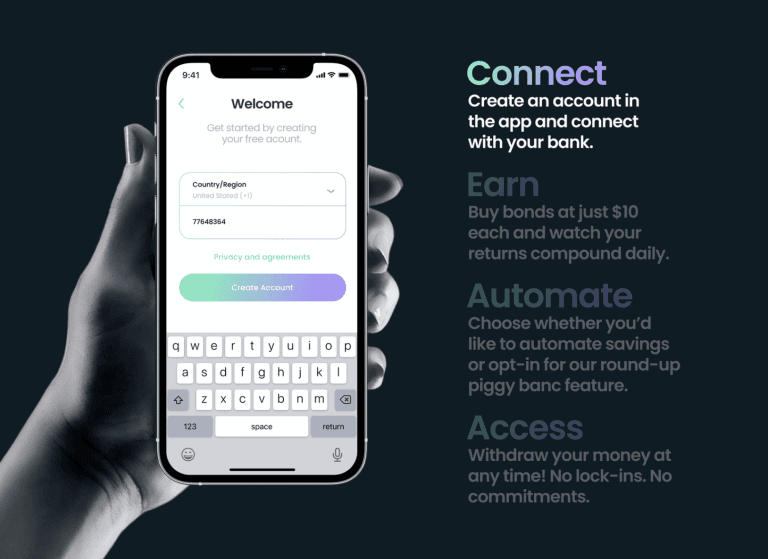

Investing

Loans

Marketing

Paying for College

Personal Finance

Press Releases

Real Estate

Retirement

Saving Money

Scams

Student Loans

Surveys

Taxes