Five Reasons to Opt Out of Credit Card Offers

No matter how many tantalizing credit offers banks dream up, you can minimize the clutter in your mailbox, thanks to the Fair Credit Reporting Act.

One of the hardest money habits to break is living off the credit cards. Whether you’ve enjoyed one too many shopping sprees or just count on your credit cards to take care of some bills now and then, increasing your debt load haphazardly is never a smart decision.

No matter how many tantalizing credit offers banks dream up, you can minimize the clutter in your mailbox, thanks to the Fair Credit Reporting Act.

The Secret Service is investigating a surge in credit card theft. The crime spree appears to have started in Wythe County and is spreading up

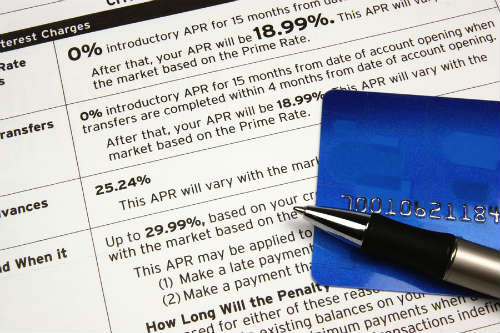

If your credit is great, or even just in fairly decent shape, you may regularly receive offers for credit card balance transfers in the mail.

Interest you accumulate on your credit card – also known as finance charges – can be difficult to pay off when you are carrying a

If you’ve finally saved up enough money to pay off your credit card balance in full, or only charged a certain amount that can be

As millions of people have filed for bankruptcy protection in recent years, many Americans want to know how to rebuild their credit rating after a

Q: One of my creditors, Bank of America, decided to decrease my credit limit from $4,000 to $500. At the time when they lowered my

Here is an article from ConsumerUnion.org that warns consumers about the new Kardashian Kard which they claim is loaded with hidden fees and weak consumer

If you missed my interview on LX New York, I talked about how I paid off over $100,000 in credit card debt:

Zero Debt outlines 30 strategies I used to get out of debt, but here are a few highlights:

1) Put your debts in writing

Many people struggling with credit card debt have absolutely no idea exactly how much they owe. Instead they “guesstimate” about their total bills — and often they’re way off with their numbers. I made this mistake when I was in debt, and it allowed me to stay in denial (and in debt!) for far too long. It wasn’t until I took an honest about my predicament — by list all my bills in black and white, and putting everything in writing — that I got serious about knocking out the debt.

Q: I have no credit card because I got into financial trouble a few years ago. I am starting to rebuild my credit and I

A subscriber to Ask The Money Coach.com wants to know if it is okay to close a secured credit card account he recently opened since he can get a new, regular card from Capital One. Click now to hear Lynnette’s answer.

Q: I am a student at Southeast Missouri State University. About 10 months ago I opened my first student credit card. I eventually got my

Accepting a settlement offer from a credit card company will negatively impact your credit rating and lower your credit scores. The reason for this is

Q: I opened A credit card account back in college in the year 2000. I have never paid it off the amount I owed. Should

Sometimes, one easy phone call is all it takes to get the interest rate on a credit card lowered. However, many people are reluctant to