My Credit Was Ruined After My Divorce. What Should I Do?

Q: “My fiance is having problems getting a mortgage. This is due to his ex‑wife’s failure to pay a previous joint mortgage with a certain

Credit scores play a huge role in your financial and personal life. Credit scores impact your ability to get a mortgage or rent an apartment, they determine whether or not you will get approved for a student loan or credit card, and your credit scores even influence the rates you pay on car insurance.

For those looking for a job, credit scores are equally important since many employers are checking job applicants’ credit ratings before determining whom to hire. The best way to stay on top of your credit health is to check your credit reports at least once a year and review your credit scores as well. The most common type of credit score is the FICO score. It ranges from 300 to 850 point. The higher your credit score, the better off you are financially.

Q: “My fiance is having problems getting a mortgage. This is due to his ex‑wife’s failure to pay a previous joint mortgage with a certain

How would you like to get one-on-one, personalized credit education information directly from a credit bureau? Actually, it’s now possible. In October 2011, Experian, one

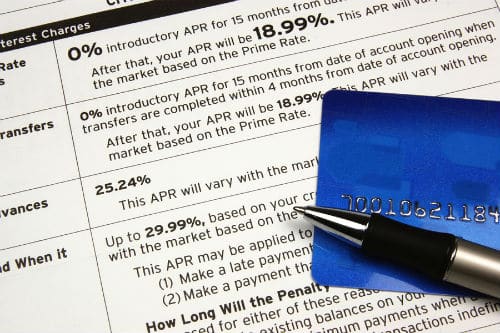

In a recent post, I told you about the importance of reading the fine print – and how it can have implications for your credit

Just in case you like to speed read articles, I’ll cut to the chase and tell you that race and gender DO NOT impact your

Q: Can putting something on layaway hurt my credit score? A: I don’t see how a layaway plan can help or hurt a consumer’s credit

In my latest book, Perfect Credit, I explained that the credit score industry prefers to work together—without you whenever possible. I’m not saying that they

Have you ever bought something or said yes to a so-called “deal” only to feel suckered later when you read – or were made aware

Debt is a massive problem in America. While some people are able to survive in this economy by taking low-interest loans, we have to accept

A credit score is simply a three-digit number that summarizes your overall credit standing and tells creditors how likely you are to either repay a

Q: “I have good credit and own four credit cards with a combined credit limit of $24, 000. Three cards are at zero balance, and

Two popular questions here at AskTheMoneyCoach.com are: “Why are my credit reports or credit scores different?” and “Why isn’t my credit score contained in my

If you went to college, no doubt you tracked your grades carefully throughout school. But if you’re currently a working professional, or are looking for

During financial literacy workshops that I give around the country, I leave about 30 – 45 minutes at the end for a q&a session with

Q: Should I pay off my credit card in full before the due date to improve my credit score? A: The answer to that question

If you’ve been struggling to keep up with your debt payments or need some professional advice about your credit, you may have considered talking to