AI Debt Payoff Planners: The Smartest Way to Crush Debt in 2025

An AI debt payoff planner uses machine learning and automation to build a personalized path to becoming debt-free and often automates payments and tracking. In

Debt is a multi trillion dollar problem in America. If you look around you, you no doubt know somebody who has debt of some kind. You probably even have debt of your own you’re looking to pay off.

An AI debt payoff planner uses machine learning and automation to build a personalized path to becoming debt-free and often automates payments and tracking. In

Hard inquiry removal guide: you can only remove a hard inquiry if it resulted from identity theft, fraud, or an error — legitimate checks stay.

Medical debt negotiation tips start with one simple action: get an itemized bill and verify every charge. Using a careful, polite approach will help you

Debt-to-income ratio fix should be your first priority if high monthly obligations are blocking mortgage approval or limiting credit options. This article explains concrete steps—paying

Buy now pay later debt help is about learning immediate steps and longer-term solutions when installment plans become unmanageable. This guide shows DIY fixes, professional

Debt consolidation pros and cons are worth weighing carefully before you combine debts into a single loan or transfer balances. This article breaks down the

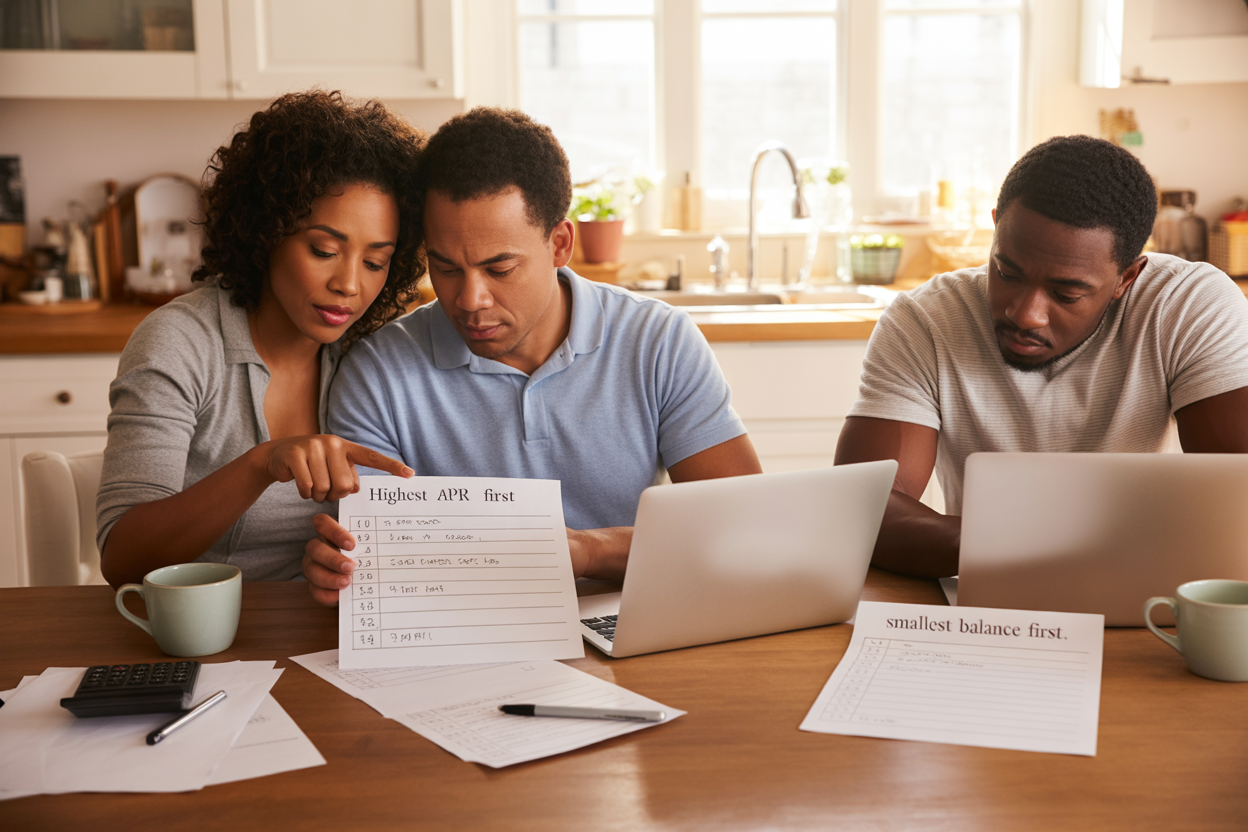

Debt avalanche vs snowball is a central debate in personal finance: one saves the most interest, the other builds quick wins to keep you motivated.

Debt settlement companies promise to reduce your debt by negotiating with your creditors, but understanding how these companies work is essential before you sign up.

Charged-off debt is one of the most damaging items that can appear on your credit report, and understanding it is essential if you want to

A Pay-for-Delete Letter is a written offer to a debt collector to pay some or all of an outstanding balance in return for the collector

If you’re being contacted by an out-of-state debt collector, you may wonder — can you be sued by a debt collector in another state? The

Balancing work, family, and personal time can be challenging for parents. Between school runs, household chores, and work commitments, finding extra hours in the day

Understanding how much of your income should go toward paying down high-interest credit card debt is one of the most important steps toward achieving financial

When facing overwhelming debt, knowing how to negotiate with debt collectors when you can’t pay in full can make all the difference in protecting your

High-interest credit card debt can feel like a heavy weight on your shoulders, affecting not just your finances but also your mental well-being. When you