Real estate investing tips for small budgets under $10,000

Real estate investing is often seen as a game for the wealthy, but in reality, you don’t need a massive amount of money to get

Here is a list of all of our articles posted under real estate on AskTheMoneyCoach.com.

Real estate investing is often seen as a game for the wealthy, but in reality, you don’t need a massive amount of money to get

When you embark on the journey of real estate investing for beginners, it’s essential to grasp the fundamental concepts that underpin this dynamic field. Real

If you are considering building an additional rental properties income stream by investing in real estate, you may be making an excellent choice to support

Air conditioning systems are essential for maintaining comfort in our homes, especially during the sweltering summer months. However, like any mechanical system, they can encounter

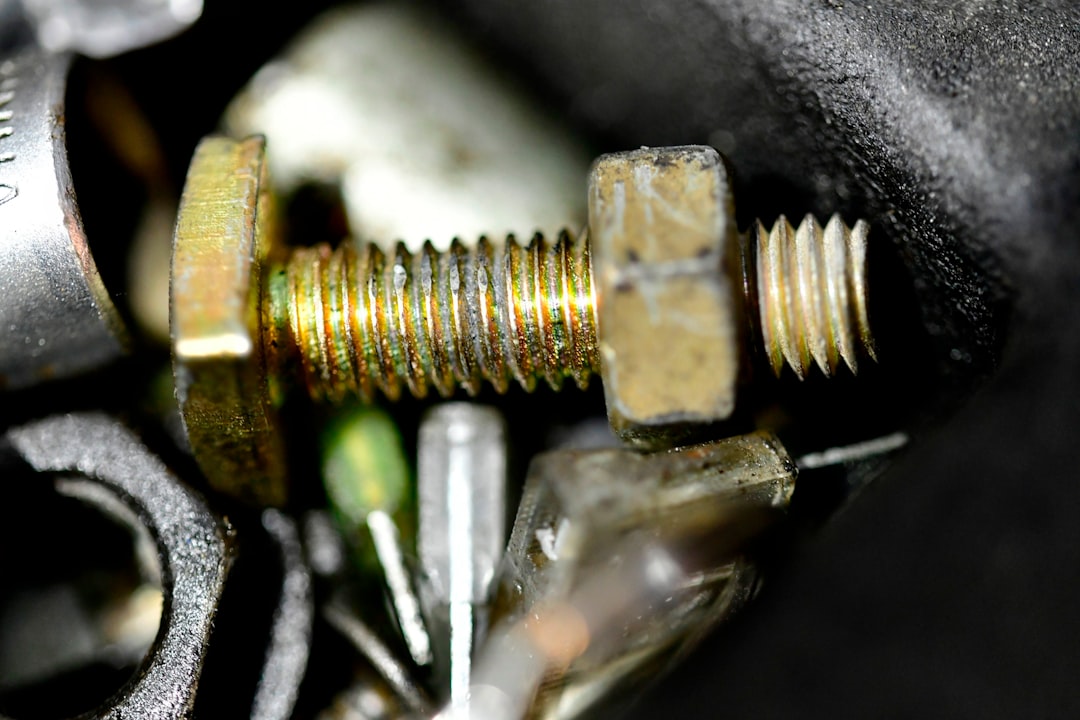

Plumbing issues are a common concern for homeowners, and understanding these problems is the first step toward effective resolution. The Plumbing Repair Playbook is a

Negotiating with contractors is a crucial skill for anyone looking to undertake a construction or renovation project. Whether you are a homeowner, a business owner,

Recognizing the signs that your HVAC system needs repair or replacement is crucial for maintaining a comfortable home environment. One of the most common indicators

HVAC systems, which stands for Heating, Ventilation, and Air Conditioning, are essential components of modern buildings, providing comfort and maintaining indoor air quality. These systems

Understanding the scope of a project is the foundational step in creating an accurate estimate. The scope defines what the project entails, including the specific

Water heaters are essential appliances in most homes, providing hot water for various needs such as bathing, cooking, and cleaning. At their core, water heaters

Electrical panel upgrades are crucial for maintaining the safety and efficiency of your home’s electrical system. The electrical panel, often referred to as the breaker

Recognizing the signs of roof damage early is essential to protecting your home. A leaking or deteriorating roof can quickly escalate from minor inconvenience to

Leak detection methods are essential tools for identifying and addressing leaks in various systems, from plumbing to industrial applications. Detecting leaks early can save significant

An emergency fund for homeowners is a crucial financial safety net, providing peace of mind in times of unexpected crises. Homeownership comes with a unique

Permits and inspections for home projects are crucial components of any home renovation project. They serve as a safeguard, ensuring that the work being done