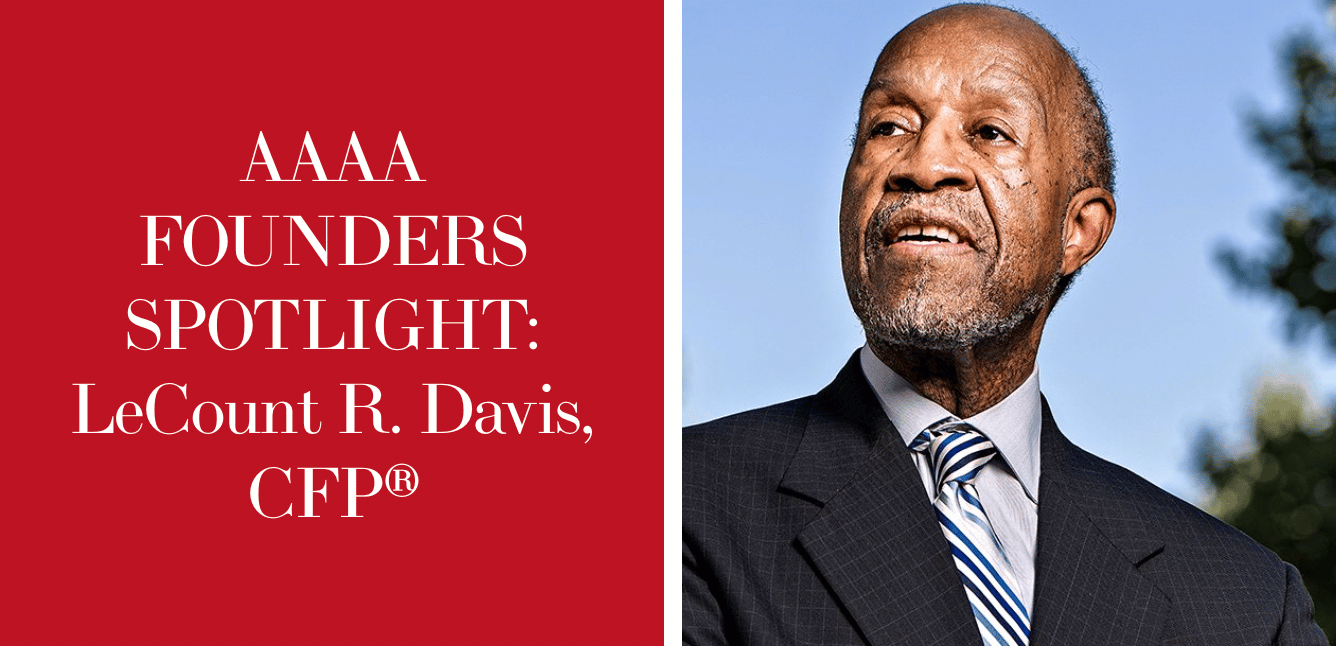

Meet LeCount R. Davis, the first African American to become a Certified Financial Planner (CFP) professional, nearly 45 years ago. Mr. Davis was recognized this month by the CFP Board of Standards, which created its first endowed scholarship in his name. He will also be honored tonight by Merrill Lynch for his lifelong achievements in the financial services industry

Among his biggest accomplishments: Mr. Davis founded the organization known as AAAA, the Association of African American Financial Advisors, which just marked its 20th anniversary.

The mission of AAAA is to help foster a future where the Black community is financially savvy with expert guidance to sustain generational wealth.

That mission, frankly, should be taken up by all financial services firms that value financial inclusion and whose executives want to close the growing wealth gap in America.

I’m grateful for pioneers and icons like Mr. Davis. But as I also candidly tell my financial services clients: they have to do better too.

It’s well past time we addressed some hard facts:

· Only 1.8% of Certified Financial Planners in the U.S. are Black (3.9% of CFPs are Asian; 2.7% are Hispanic; and 83% are White)

· Just 2% of Certified Public Accountants (CPAs) in the United States are African Americans

· White households have 8 times the wealth as do Black households

One way to narrow the wealth gap is to expand the talent pool of African Americans and other people of color working throughout the financial ecosystem: at banks, brokerages, investment houses, insurers, fintech companies, accounting firms, hedge funds, credit unions and more.

This is a topic I speak about often because I’m passionate in my advocacy for the African American community and for underserved populations.

I also know that people typically do business with others they know, trust and like – as well as those who look like them.

Some of it is just human nature; what diversity, equity and inclusion experts call the “affinity factor” or “affinity bias.”

But it’s 2022. We can’t reasonably expect an overwhelmingly White, male-dominated industry to service all the needs of our increasingly diverse society. For starters: We need more women in the profession! (77% of CFPs identify as male, and only 23% as female, the CFP Board reports).

We must all recognize, of course, that we also need many more LeCount Davis’s in the financial world, from entry level jobs and back office positions to senior manager/director roles and the C-suite too.

That way, the next time an African American walks into a bank, engages with an investment firm, or seeks financial help anywhere, that customer – or prospective client – just might feel way more comfortable. And maybe that increased comfort level will make them more inclined to do business, learn something new, and get the financial products, services and advice they need to grow their wealth.

That’s a win-win for everyone.

Follow Lynnette on LinkedIn