Are you nearing retirement and wondering how to improve your credit score? Even if you’re in your late 40s, 50s or 60s, your credit score plays a significant role in your financial well-being, and taking the time to raise it before retirement can have long-term benefits.

So it’s wise to know some smart strategies to help pre-retirees like you boost their credit scores and secure a stronger financial future.

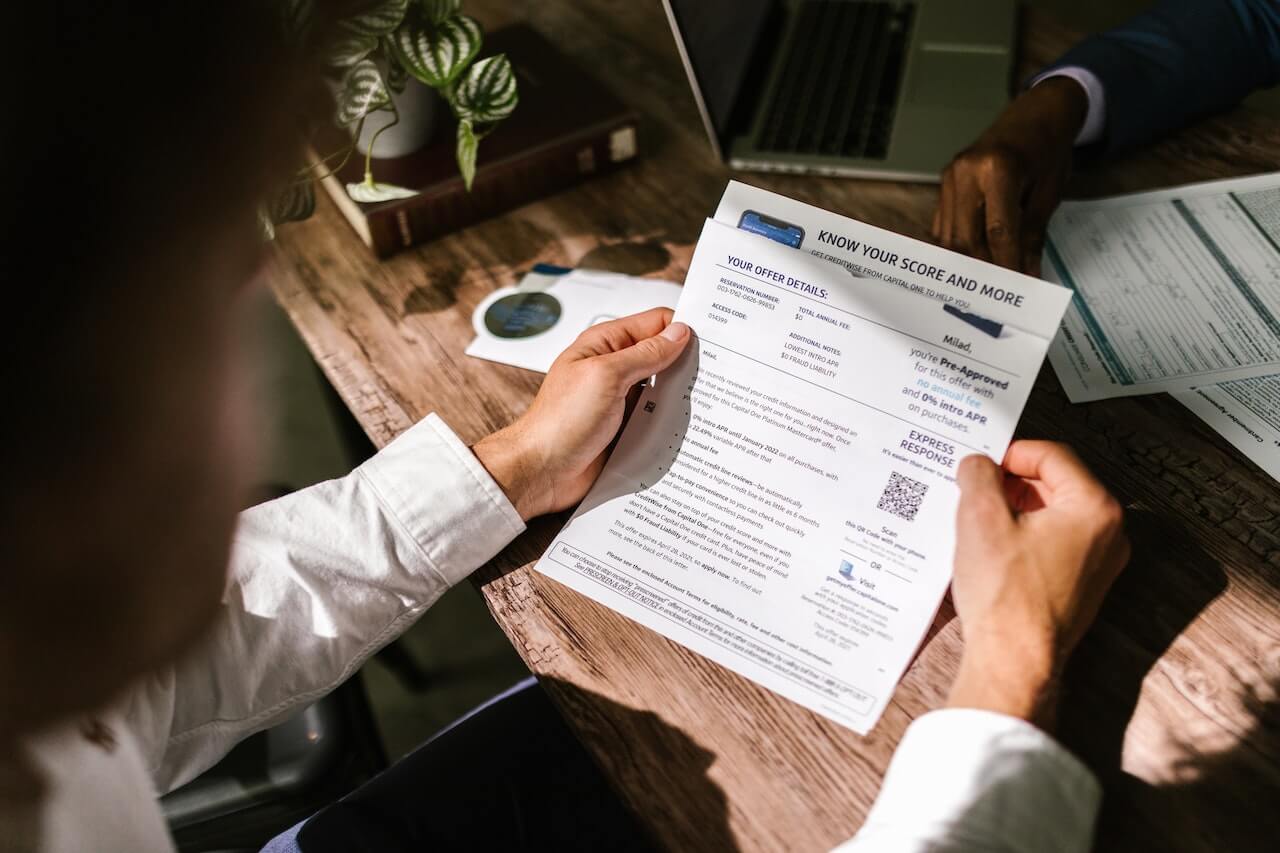

Your credit score is more than just a number. It’s a reflection of your financial stability and responsibility. Lenders use it to determine whether you qualify for loans, credit cards, or other forms of credit. A good credit score can open doors to better interest rates and terms, while a poor credit score can limit your options and increase your costs.

As you approach retirement, maintaining and improving your credit score becomes even more crucial. You may need access to credit for emergencies, unexpected expenses, or even financing a retirement project.

By following some simple strategies, you can raise your credit score and ensure a smoother transition into retirement.

To help you improve your credit health, read on to learn more about the world of credit scores, exploring what they are, why they matter for pre-retirees, and the factors that impact them. We will also discuss the importance of reviewing your credit report, managing debt effectively, building a solid credit history, avoiding common credit score mistakes, seeking professional guidance, and protecting your personal information.

Understanding Credit Scores

When it comes to financial well-being, credit scores play a crucial role. Whether you’re a pre-retiree or not, understanding credit scores is essential for your financial success. In this section, we will dive into what credit scores are, why they are important for pre-retirees, and the factors that affect them.

What is a Credit Score?

Simply put, a credit score is a three-digit number that represents your creditworthiness. Lenders and creditors use this number to assess the risk of lending you money or extending credit. A higher credit score indicates that you are a responsible borrower, while a lower credit score may suggest a higher risk.

Credit scores are typically calculated based on your credit history, and they can range from 300 to 850. The most commonly used credit scoring model is FICO Score, developed by the Fair Isaac Corporation. Other scoring models, such as VantageScore, also exist.

Importance of Credit Scores for Pre-retirees

As you approach retirement, your financial situation may change. It’s important to maintain a good credit score during this transition for several reasons:

- Access to Credit: Even in retirement, you may need credit for major expenses like a new car, home repairs, or medical bills. A good credit score can help you secure loans or credit on favorable terms.

- Insurance Rates: Your credit score can impact your insurance rates. A higher score may qualify you for lower rates, helping you save money on insurance premiums.

- Renting or Buying a Home: If you plan to downsize, relocate, or rent a new home in retirement, landlords and mortgage lenders often consider credit scores as part of the application process.

Factors Affecting Credit Scores

Several factors influence your credit score. Understanding these factors can help you take the necessary steps to improve your creditworthiness:

- Payment History: This is the most significant factor that affects your credit score. Making payments on time and in full demonstrates your reliability as a borrower.

- Credit Utilization: The percentage of available credit that you use impacts your score. Keeping your credit card balances low compared to your credit limit is beneficial for your credit score.

- Length of Credit History: The longer your credit history, the better it reflects your ability to handle credit. It’s important to maintain old credit accounts to show a long history of responsible borrowing.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, shows that you can manage different types of credit responsibly.

- New Credit Applications: Applying for multiple lines of credit within a short period may be seen as a risk. Limit new credit applications to avoid potential negative effects on your credit score.

Understanding these factors allows you to make informed decisions and take proactive steps to raise your credit score. In the next section, we will discuss the importance of reviewing your credit reports regularly.

Reviewing Credit Reports

One of the most important steps in improving your credit score is to review your credit reports regularly. By reviewing your credit reports, you can identify any errors or inaccuracies that may be dragging down your score. Here are some key points to keep in mind when reviewing your credit reports:

Obtaining a Free Credit Report

- You are entitled to a free copy of your credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion – once every 12 months. You can request your free annual credit report online or by mail.

- Reviewing all three reports can give you a comprehensive view of your credit history and help you spot any inconsistencies or discrepancies.

Checking for Errors and Inaccuracies

- Carefully go through your credit report and check for any errors or inaccurate information. This could include incorrect personal information, accounts that don’t belong to you, or late payments that were actually paid on time.

- Look for any signs of identity theft, such as accounts you didn’t open or inquiries you didn’t authorize.

- Pay attention to the details and make note of any discrepancies you find.

Disputing Inaccurate Information

- If you find any errors or inaccuracies on your credit report, it’s important to dispute them with the credit bureau. You can do this online or by mail.

- Provide any supporting documentation or evidence to back up your claim. This could include payment receipts, confirmation letters, or any other relevant information.

- The credit bureau is legally obligated to investigate your dispute and correct any inaccuracies within 30 days.

Reviewing your credit reports regularly is crucial for maintaining a healthy credit score. Taking the time to check your reports for errors and inaccuracies can help you address any issues quickly and effectively. By staying on top of your credit reports, you can ensure that your credit history is accurate and up to date.

Managing Debt Effectively

As pre-retirees, it’s crucial to manage debt effectively to maintain a healthy credit score. By tackling debt head-on and implementing smart strategies, you can improve your creditworthiness and pave the way for a peaceful retirement. Here are some tips to help you manage debt effectively:

Creating a Budget and Sticking to It

- Start by tracking your expenses: Take a close look at your monthly expenses and identify areas where you can cut back. This could include dining out less frequently or reassessing utility bills and subscriptions.

- Create a realistic budget: Based on your income and expenses, create a budget that allows for debt repayment while still meeting your essential needs. Set aside funds for savings and emergencies as well.

- Stick to your budget: Discipline is key when managing debt. Avoid unnecessary spending and stay committed to your budget. Consider using budgeting apps or spreadsheets to help you stay organized and on track.

Reducing Credit Card Balances

- Prioritize high-interest debt: If you have multiple credit cards, focus on paying off the ones with the highest interest rates first. This strategy will save you money in the long run.

- Pay more than the minimum payment: Try to pay more than the minimum payment on your credit cards each month. By paying more, you’ll chip away at the principal balance and reduce interest charges.

- Consider balance transfers or consolidation loans: If you’re struggling to manage multiple credit card payments, explore the option of transferring balances to a card with a lower interest rate or consolidating your debts into a single loan. This can simplify your payments and potentially lower your interest costs.

Paying Bills on Time

- Set up automatic payments: Avoid late payments by setting up automatic payments for your bills. This ensures that your payments are made on time, reducing the risk of late fees and negative marks on your credit report.

- Create reminders: If automatic payments aren’t an option, set reminders for yourself. Use your phone’s calendar or a task management app to alert you of upcoming due dates.

- Contact creditors if you’re struggling: If you find yourself facing financial hardship and unable to make a payment on time, it’s important to reach out to your creditors. Many lenders are willing to work with you and offer assistance, such as payment plans or temporary hardship programs.

Remember, managing your debt effectively not only improves your credit score but also reduces financial stress. By following these strategies, you’ll be well on your way to a healthier financial future and a more secure retirement.

Building a Solid Credit history

Building a solid credit history is essential for pre-retirees who want to ensure financial stability in their retirement years. A strong credit history not only helps in obtaining loans and credit cards with favorable terms but also plays a significant role in securing housing, insurance, and even job opportunities. Here are some smart strategies to build a solid credit history:

Opening and Managing Credit Cards Wisely

- Choose the right card: Before applying for a credit card, research different options and select one that best suits your needs. Look for cards with low interest rates, no annual fees, and rewards programs that align with your spending habits.

- Use credit responsibly: Once you have a credit card, remember to use it responsibly. Charge only what you can afford to pay off each month. Avoid maxing out the credit limit and keep a low credit utilization ratio (the percentage of available credit you’re using).

- Make timely payments: Paying your credit card bills on time is crucial for building a solid credit history. Late payments can negatively impact your credit score, so set up automatic payments or create reminders to ensure you never miss a payment.

- Avoid excessive credit inquiries: Every time you apply for a new credit card, it results in a hard inquiry on your credit report, which can slightly lower your credit score. Apply for new credit sparingly to avoid unnecessary inquiries.

Utilizing Credit Builder Loans

- What are credit builder loans?: Credit builder loans are specifically designed to help individuals establish or improve their credit history. These loans require you to make monthly payments that are reported to credit bureaus, helping you build a positive payment history.

- How do credit builder loans work?: Rather than receiving the loan funds upfront, credit builder loans involve depositing money into a separate account. You then make monthly payments to repay the loan while gradually building credit history.

- Consider secured credit cards: If you’re having trouble qualifying for a traditional credit card, a secured credit card can be a useful tool for building credit. A secured credit card requires a cash deposit as collateral, limiting the lender’s risk and helping you build credit.

Being an Authorized User on Someone’s Account

- What does being an authorized user mean?: Being an authorized user means you have permission to use someone else’s credit card account. As an authorized user, the account’s payment history will be included in your credit report, even if you’re not responsible for making payments.

- Choose the right account: To benefit from being an authorized user, select an account that has a positive payment history and low credit utilization. A family member or a close friend who has a good credit score may be willing to add you as an authorized user on their account.

- Communicate openly: Before becoming an authorized user, have a conversation with the primary account holder to establish guidelines and expectations. Ensure that both parties understand the responsibility involved and agree on how the account will be used.

Building a solid credit history takes time and discipline, but the rewards are well worth the effort. By managing credit cards wisely, utilizing credit builder loans, and leveraging authorized user accounts, pre-retirees can establish a strong credit foundation for a financially secure future.

“A good credit history is not just about financial opportunities; it’s about peace of mind.” – Suze Orman

Avoiding Common Credit Score Mistakes

Maintaining a good credit score is crucial for pre-retirees who want to secure their financial stability and enjoy a stress-free retirement. While it’s important to focus on positive strategies to improve your credit score, it’s equally important to avoid common mistakes that can have a negative impact. Here are some common credit score mistakes to avoid:

Closing Old Credit Accounts

Closing old credit accounts may seem like a good idea to simplify your financial life, but it can actually hurt your credit score. Length of credit history is an important factor in determining your credit score, and closing old accounts can shorten your credit history. It’s best to keep your old credit accounts open, even if you don’t use them often. Keeping them active can help maintain a longer credit history and demonstrate responsible credit management.

Opening Multiple New Accounts

When you’re trying to improve your credit score, it may be tempting to open multiple new credit accounts to increase your available credit. However, this can backfire and actually lower your credit score. Opening too many new accounts in a short period of time can be seen as a sign of financial instability and can make lenders wary. Instead, focus on managing your existing credit accounts responsibly and only open new accounts when necessary.

Maxing out Credit Cards

Using too much of your available credit can have a negative impact on your credit score. Credit utilization, which is the percentage of your available credit that you’re using, is an important factor in determining your credit score. Maxing out your credit cards or carrying high balances can indicate to lenders that you’re relying too heavily on credit and may be at risk of not being able to repay your debts. Aim to keep your credit utilization below 30% to maintain a good credit score.

Remember, your credit score is a reflection of your financial responsibility and can have a significant impact on your ability to get favorable terms on loans and credit cards. By avoiding these common credit score mistakes, you can set yourself up for a solid financial future and enjoy a worry-free retirement.

“It’s best to keep your old credit accounts open, even if you don’t use them often. Keeping them active can help maintain a longer credit history and demonstrate responsible credit management.”

Seeking Professional Guidance

While managing your credit score on your own can be effective, seeking professional guidance can provide you with expert insights and personalized strategies. Pre-retirees, in particular, may benefit greatly from working with certified credit counselors or financial planners who specialize in credit management. These professionals have a deep understanding of the credit system and can offer valuable advice tailored to your specific situation. Here are some reasons why you should consider seeking professional guidance:

- Specialized Knowledge: Certified credit counselors have extensive knowledge of credit management and can provide you with the tools and strategies to improve your credit score. They can help you understand the complex factors that affect your credit and guide you towards the most effective solutions.

- Personalized Approach: Every individual’s credit situation is unique. A credit counselor or financial planner can analyze your specific circumstances and develop a customized plan to help you raise your credit score. This individualized approach ensures that you receive the most relevant advice and solutions for your specific needs.

- Credit Education: Working with a professional can also provide you with valuable education about credit. These experts can teach you about responsible credit behavior, how to read your credit report, and the best practices for managing debt. This knowledge can empower you to make informed decisions and maintain a healthy credit score in the long run.

- Establishing Realistic Goals: A professional credit counselor or financial planner can help you set realistic and achievable goals for improving your credit. They will take into account your financial situation, your future plans, and any unique challenges you may face as a pre-retiree. Setting realistic goals is essential to avoid frustration and maintain motivation throughout the credit improvement process.

- Negotiating with Creditors: If you’re struggling with debt, professional guidance can be invaluable. Credit counselors can negotiate with your creditors on your behalf, seeking lower interest rates, waived fees, or revised payment plans. These negotiations can help you reduce your debt burden and make it more manageable.

Remember, it’s important to choose a reputable and certified professional when seeking guidance. Look for trusted groups such as the National Foundation for Credit Counseling (NFCC) or the Financial Counseling Association of America (FCAA). Consider asking for recommendations from friends, family, or trusted financial advisors.

Seeking professional guidance can be a smart strategy for pre-retirees looking to raise their credit scores. Certified credit counselors or financial planners can provide you with specialized knowledge, personalized approaches, and valuable education about credit. They can help you set realistic goals and negotiate with creditors on your behalf. Working with professionals can give you the confidence and support you need to improve your credit score and achieve your financial goals.

Protecting Personal Information

Protecting your personal information is crucial in today’s digital age. With the increasing prevalence of data breaches and identity theft, it’s more important than ever to take proactive measures to safeguard your sensitive data. This is particularly important for pre-retirees who may be more vulnerable to these types of attacks. Here are some smart strategies to help protect your personal information and keep your credit score safe:

Monitoring Credit Reports and Accounts

Regularly monitoring your credit reports and accounts is one of the most effective ways to detect any fraudulent activity and protect your personal information. By staying informed about the status of your credit, you can identify and address any suspicious or unauthorized activities immediately. Here are a few tips for monitoring your credit reports and accounts:

- Check your credit reports: Obtain free copies of your credit reports from the three major credit bureaus (Equifax, Experian, and TransUnion) and review them carefully for any discrepancies or unfamiliar accounts.

- Set up credit monitoring alerts: Sign up for credit monitoring services that provide alerts about any changes or inquiries on your credit reports. This will allow you to stay informed and take immediate action if any suspicious activities occur.

- Review your credit card and bank statements: Regularly review your credit card and bank statements for any unauthorized charges or withdrawals. If you notice any discrepancies, contact your financial institution as soon as possible.

Using Secure Online Practices

With the increasing use of online platforms for financial transactions and communications, it’s important to practice good security habits to protect your personal information. Here are some essential tips for using secure online practices:

- Secure your devices: Install updated antivirus software, use strong and unique passwords, and enable two-factor authentication for all your online accounts.

- Beware of phishing scams: Be cautious about clicking on links or downloading attachments in suspicious emails or messages. Phishing scams are designed to trick you into revealing your personal information or login credentials.

- Use secure websites: When making online purchases or submitting personal information, ensure that the website has a secure connection (look for “https” in the URL) and a padlock icon in the browser.

- Avoid public Wi-Fi networks for sensitive transactions: Public Wi-Fi networks may not be secure, so it’s best to avoid using them for financial transactions or accessing sensitive information.

Remember, protecting your personal information is an ongoing process. Stay vigilant and regularly update your security measures to adapt to new threats and vulnerabilities. By following these strategies, you can help safeguard your personal data and maintain a healthy credit score.

“Your personal information is like your financial DNA. Protecting it is essential for maintaining a healthy credit score and financial well-being.”

Taking Care of Your Credit Health

Raising your credit score is an important step for pre-retirees to ensure a secure financial future. By understanding credit scores, reviewing credit reports, managing debt effectively, building a solid credit history, avoiding common credit score mistakes, seeking professional guidance, and protecting personal information, you can take control of your credit and improve your overall financial health. Remember that it’s never too late to start working on improving your credit score, and every small step you take can make a big difference.

If you want to learn more about managing your personal finances, visit AskTheMoneyCoach.com. They offer a wealth of resources on budgeting, saving, investing, credit/debt management, insurance, and more. With personalized financial coaching and guidance from experts in the field, you’ll find the support you need to achieve your financial goals.

Take control of your financial future and start building a better credit score today. Your retirement years should be stress-free and filled with joy, and having a healthy credit score is an essential part of that equation. Don’t wait another day – start implementing these smart strategies and watch as your credit score improves over time.

Remember, your credit score is a reflection of your financial responsibility and can have a significant impact on your ability to secure loans, mortgages, and other financial opportunities. Take the time to understand your credit score and take active steps to improve it. Your future self will thank you!

So why wait? Start implementing these strategies now and watch your credit score soar. Visit AskTheMoneyCoach.com for more information and resources to help you on your journey to financial success. Don’t miss out on this valuable opportunity to improve your credit and secure a brighter future.

Remember, your credit score matters, and the time to take action is now!

Frequently Asked Questions

- Why is it important for pre-retirees to raise their credit scores?Raising credit scores is important for pre-retirees as it can help them secure better interest rates on loans, qualify for lower insurance premiums, and have more flexibility with financial decisions during retirement.

- What are some smart strategies to raise credit scores for pre-retirees?Some smart strategies to raise credit scores for pre-retirees include paying bills on time, reducing credit card balances, keeping credit utilization low, checking credit reports regularly for errors, and avoiding new credit applications unless necessary.

- How long does it take to raise a credit score?The time it takes to raise a credit score depends on various factors such as the current credit score, the extent of negative items, and the consistency of positive credit behavior. Generally, it can take several months to a year to see significant improvements.

- Can pre-retirees with low credit scores still improve their financial situation?Yes, pre-retirees with low credit scores can still improve their financial situation. By following smart credit-building strategies, they can gradually raise their scores and qualify for better financial opportunities, including loans and credit cards with favorable terms.

- Should pre-retirees seek professional help to improve their credit scores?While it is not necessary for pre-retirees to seek professional help to improve their credit scores, it can be beneficial, especially if they have complex credit issues or are unsure about the best course of action. Credit counseling agencies or financial advisors can provide guidance and personalized solutions.