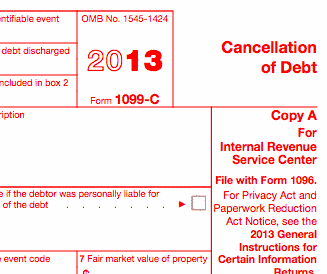

The 1099-C Explained: Foreclosure, Short Sale, Debt Forgiveness

If you recently received a 1099-C, Cancellation of Debt, you may be wondering what to do with that form and how to use it when filing your income tax return. You were likely sent a 1099-C if your home went into foreclosure in 2012, you did a short sale on any property, or if a […]

The 1099-C Explained: Foreclosure, Short Sale, Debt Forgiveness Read More »