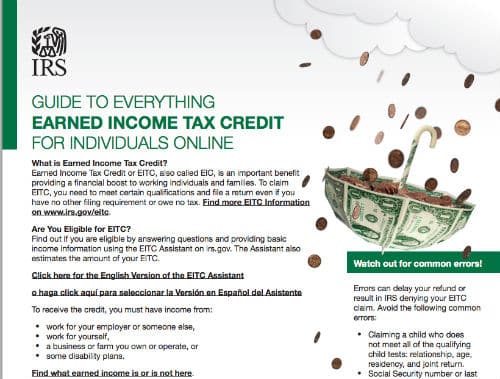

About The Earned Income Tax Credit

The Earned Income Credit (EIC), also known as the Earned Income Tax Credit (EITC), is designed to help you keep more of your hard earned money. It is a refundable tax credit, meaning you could qualify for a refund even if you did not have any income tax withheld from your paychecks. This article explains who is eligible […]

About The Earned Income Tax Credit Read More »