While retailers roll out their Black Friday and pre-Christmas deals, and people start talking about doing their holiday shopping, you might be broke – and feeling like you’re sitting there with a 600-pound gorilla in your room.

You are trying not to notice him, but he is there.

He is causing you stress and anxiety. He shows up every year around this time.

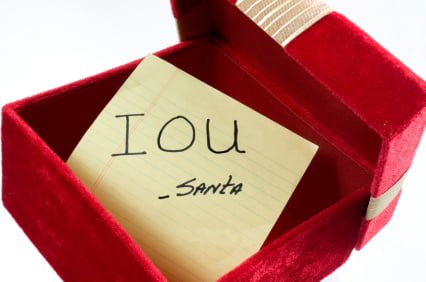

That gorilla is called Santa. And you’re feeling stressed because your kids, your friends, your co-workers, family members or your spouse or significant other all have these high expectations of you — as if you’re Santa, right?

They could be spoken or unspoken expectations. But they’re real either way. And the expectations are clear: someone wants you to buy them presents this year, even though you’re broke yet again.

Well, here are four quick ideas to deal with those expectations, avoid blowing what little money you have, and lower your holiday stress in the process.

Tip# 1: Have a Family Meeting

Share your real and true budget with loved ones close to you. If they live with you, they should know the real deal, and it’s best not to have them pining away for lavish gifts that you simply can’t afford.

So round up your kids, your spouse or boyfriend/girlfriend, or the sister who lives with you. Show them a rough picture of your bills and at least a general idea of your income too.

Explain that money is tight and ask if there’s anything special you could do, make or experience with them as your way of providing a special, personalized gift. Be clear that this is how you’d love to give them a gift – not by buying presents.

Maybe your son would love it if you’d take him to a local basketball game (a free one) at the college nearby. Or perhaps your spouse would be forever grateful if you gave him or her “the day off” and you took care of the cleaning, cooking and the kids.

You get the point. The idea is to come up with creative, meaningful ways to show your love and appreciation for those closest to you this holiday season – without gong into debt or draining your bank account.

Tip #2: Use the Single-Item Gift Strategy

If you’re going to buy gifts – and really, you don’t have to – you should ask family members and loved ones to make a brief holiday wish list including inexpensive and moderately priced items. Then explain that you will be getting each person one – yes, I said one! – single gift off that list.

Remember, making merry during the holidays doesn’t have to mean a living-room full of presents.

Quality, including practicality and thoughtfulness of a gift, trumps quantity during the holidays – despite all the holiday commercials to the contrary. Those commercials and advertisements are designed simply to get you to spend, spend, spend.

But you don’t have to buy each person on your gift list two, three, or even four or five gifts to say “Merry Christmas.”

Tip #3: Try the Family Gift Technique

If you can swing it in your family, see if your relatives are willing to sort of “pool” a gift list.

By this, I mean: can you identify gifts that the whole family can benefit from? If so, you may be able to make one meaningful purchase as opposed to many, more expensive gifts.

Tip #4: Put a Few Special Offers on the Table – For Later

You might be surprised at some things your kids or your better half might be willing to forgo now, during the holidays, if they knew they could get something “better” later, or at least something that was longer-lasting.

How about no gifts, but a family vacation next summer? No gifts, but we all join the YMCA or a new health club for 1 year? No gifts, but now the kids will get a $50 per month allowance (or whatever you can afford) if they promise to also keep their grades up? No gifts, but we’ll fix that ugly dent in the car so you won’t be so embarrassed when I pick you up from school or work.

Again, hopefully you get the point: Delay excessive holiday spending now for a better or different payoff later.

By the way, my husband and I have successfully used this strategy. For example, one year, instead of spending ridiculous amounts of dollars on holiday gifts, the family agreed that we all would prefer a holiday getaway to Florida. Another year we took a road-trip vacation to Vermont. We still have the benefit of the nice family memories from those trips. However the clothes and junk that we purchased from Christmases past…they’re long gone.

The main idea is to get yourself – and your family – ready for the onslaught of holiday marketing that occurs from November through the New Year.

Do it now so that when you are bombarded with holiday songs or relentless newscasts about holiday shopping, instead of anxiety you will feel a sense of calm and satisfaction.

You will know that not becoming a half-crazed shopper, not participating in a 5 a.m. door-buster event, and even avoiding the lure of Black Friday or Cyber Monday sales won’t mean your holiday is wrecked.

On the contrary, you’ll be able to put aside much of the commercialism of the holiday season and focus on what’s really important: spirituality, love of family and friends, and an appreciation of all the blessings you have – regardless of your bank account.