IRS Offer in Compromise Explained

While it’s been often said that the two things you can’t escape in life are death and taxes, the IRS actually offers a way out

It hurts to get a big tax bill and find out that you owe the government. But there are some ways you can start to lower your taxes in the future.

While it’s been often said that the two things you can’t escape in life are death and taxes, the IRS actually offers a way out

If you’ve prepared your taxes and you owe Uncle Sam, don’t make the mistake of not submitting your federal tax return simply because you’ve got

Tax season often turns into stress season for a lot of Americans. Whether it’s the pressure of organizing financial documents or fears about getting audited,

Didn’t file your 2014 taxes by April 15, 2015? No worries, we’ll let you in on an industry secret – if you’re getting a refund,

What is e-file? How do you e-file your taxes? We explain it all in this short and sweet article. What is e-file? eFile, also known

What is a W-2? Simply put, a W-2 is a tax form your employer sends you, known as a Wage and Tax Statement. Sounds simple, then why are

Most of us don’t particularly enjoy dealing with the deadlines and paperwork required to file federal income taxes. But just because taxes may not be

Intuit/TurboTax, one of the tax industry giants, suffered a black eye recently when they were forced to stop e-filing state tax returns for a period of

Tax season is upon us and if you’re expecting an IRS tax refund you’re probably quite eager to see that check. After all, the IRS

College is awesome, right? For most of us, it’s the first time we tasted freedom. The freedom to do whatever, whenever you want. The downside

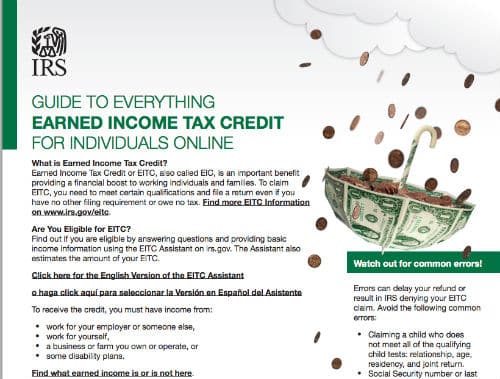

The Earned Income Credit (EIC), also known as the Earned Income Tax Credit (EITC), is designed to help you keep more of your hard earned money.

What is the 1040EZ? The 1040EZ form (aka the EZ form) is the simplest and shortest form you can use to file your federal income taxes.

As we head into the holidays, there is still time to convert your small business into an S Corporation which save you thousands of dollars

The IRS says U.S. taxpayers spend an average of 13 hours reading up on tax rules, gathering paperwork, and filling out their tax forms. And

Q: My wife and I are preparing our taxes ourselves this year. We have over $1000 worth of medical co-pay expenses but we can’t get these

©2009-2023 TheMoneyCoach.net, LLC. All Rights Reserved.

RSS / Sitemap /Submit an Article / Privacy Policy / LynnetteKhalfaniCox.com

Do Not Sell My Personal Information / Acceptable Use Policy / DSAR / Cookie Policy

Disclaimer / Limit the Use of My Sensitive Personal Information /