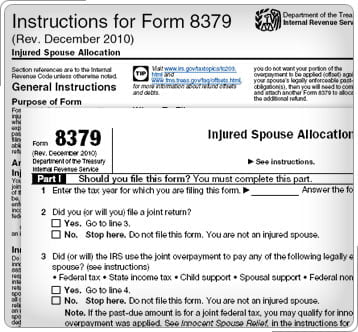

How to Claim Injured Spouse Relief from the IRS: Form 8379

Did you file a joint income tax return and expect to get a big check back from Uncle Sam only to find out that the government kept all or part of your refund? If so, the feds probably think you – or your spouse – have a delinquent debt that must be paid before you […]

How to Claim Injured Spouse Relief from the IRS: Form 8379 Read More »