Should You Record a Call with a Bill Collector?

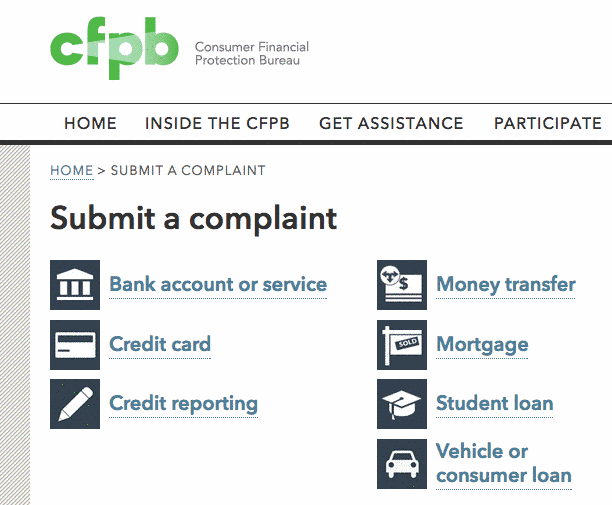

Your bill collector may have sent you a letter contacting you about your outstanding debt or called you to introduce themselves. If you choose to accept a phone call and engage a debt collector in conversation, you may have more negotiating power if you record your call. You do have the right to record your […]

Should You Record a Call with a Bill Collector? Read More »