I Can’t File My Taxes Because Someone Used My SSN – What Do I Do?

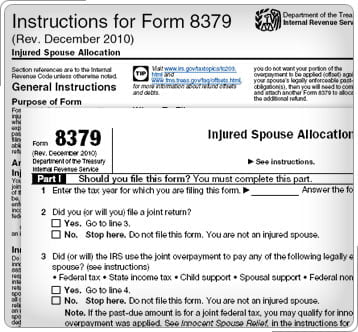

Q: I am unable to file my taxes because someone used my social security number. What should I do? A: If you recently found out that someone used your Social Security number to file taxes, you will need to report the fraudulent activity to the Internal Revenue Service (IRS) immediately. The IRS usually sends out […]

I Can’t File My Taxes Because Someone Used My SSN – What Do I Do? Read More »