Checking your FICO credit score at least once a year is a good way to stay on top of your credit rating.

That’s why you may be happy to learn that myFICO.com – the consumer website of Fair Isaac, creator of the FICO score – is offering you the opportunity to get your FICO score instantly online and free of charge.

So is there a “catch” for you to get a free FICO credit score?

Yes, there is.

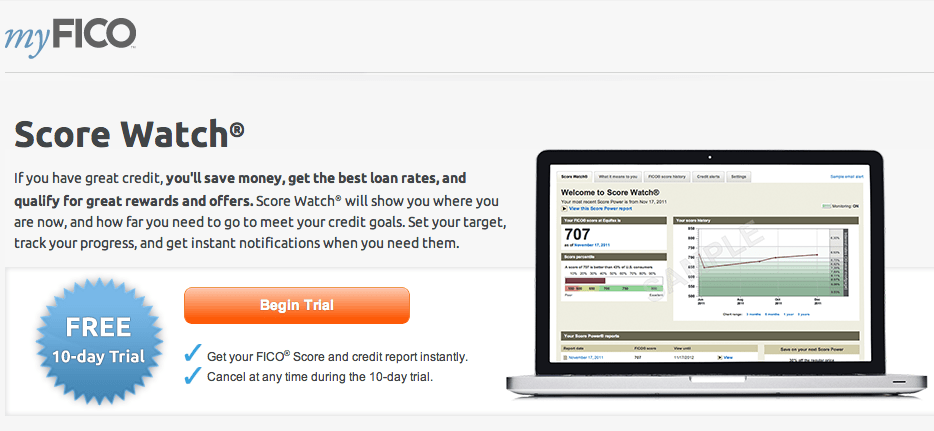

The “catch” is that you only get the free FICO credit score when you agree to a 10-day trial offer for FICO’s Score Watch product, a credit monitoring service that keeps tabs on your FICO score and tracks important changes in your Equifax credit report.

Now even though FICO’s free credit score is contingent upon the “trial offer,” I still think this freebie from FICO is a good promotion, and one you should take advantage of for several reasons.

First of all, FICO scores are used by 90% of the top banks in America. Therefore, if you’re planning to apply for car financing, a mortgage, student loan or a credit card in the next few months or so, you should know your FICO credit score ahead of time.

Secondly, even if you aren’t in the market for a loan or credit, knowing your FICO score is still vital. That’s because your credit standing impacts many areas your life, like your car insurance rates and your ability to get a job or secure a promotion.

Finally, this free credit score offer is easy to tap, even if you don’t want credit monitoring, simply by canceling the Score Watch service within 10 days. Either way, you still get to check your FICO credit score immediately and at no cost.

The Fine Print

Now let me tell you a little more about the fine print of this free credit score offer, some important details, and other options you should know.

To obtain your free credit score, you have to go the myFICO free trial page and create an account that has your personal information, like your name and address, as well as your credit card info.

For now, you’re just inputting your credit card data. Remember: you’re not immediately getting charged for anything. And again, FICO won’t make you pay anything as long as you cancel within the 10-day trial period.

Should you choose to cancel within the 10-day window, the cancellation process is quick and easy. Just call and terminate the service and it’s done.

MyFICO even sends you an email three days before the trial ends to remind you to either keep the credit monitoring or cancel it before your 10 days are up.

If you do decide keep Score Watch because you want ongoing credit monitoring, be aware that myFICO’s service requires a three-month minimum subscription. And the credit monitoring currently costs $14.95 per month.

In other words, if you go beyond that 10-day trial offer, you’re going to wind up being locked into the credit monitoring service for at least three months and that will cost you roughly $45.

So I repeat: If you only want the free FICO credit score, sign up for the trial offer and be sure to cancel within the 10-day period.

Those who keep their credit monitoring subscription not only get free FICO scores and instant access to their Equifax credit reports, they also get a second Equifax credit report at any time during the subscription; additional credit reports are offered at a 30% discount.

Other Options for Free Credit Monitoring

But what if you want ongoing credit monitoring and you don’t want to pay for it?

Actually, there are a couple of other companies that offer completely free credit monitoring – but they don’t let you monitor your Equifax report.

For example, Credit Sesame offers free credit monitoring where you can track changes to the data in your Experian credit report. Also, Credit Karma offers free credit monitoring to allow you to track the info in your TransUnion credit report. Neither company requires a trial offer; and neither makes you supply your credit card data.

As of this writing, in December 2012, I don’t know of any company offering you free credit monitoring of your Equifax credit report; until that happens the FICO offer seems to be the best deal on the market.

As I stated in my book, Perfect Credit, I’ve actually used myFICO’s credit monitoring service for years, and it’s definitely been instrumental in helping me stay on top of my credit.

Likewise, other credit monitoring services, including Credit Sesame and Credit Karma, have also been tremendously helpful to me in maintaining stellar credit.

That’s why I’ve written extensively about the benefits of credit monitoring.

The bottom line is: With credit playing such a huge role in our lives, I continue to advocate for credit monitoring because I see it as an important tool for improving one’s credit scores and learning how to manage credit wisely.