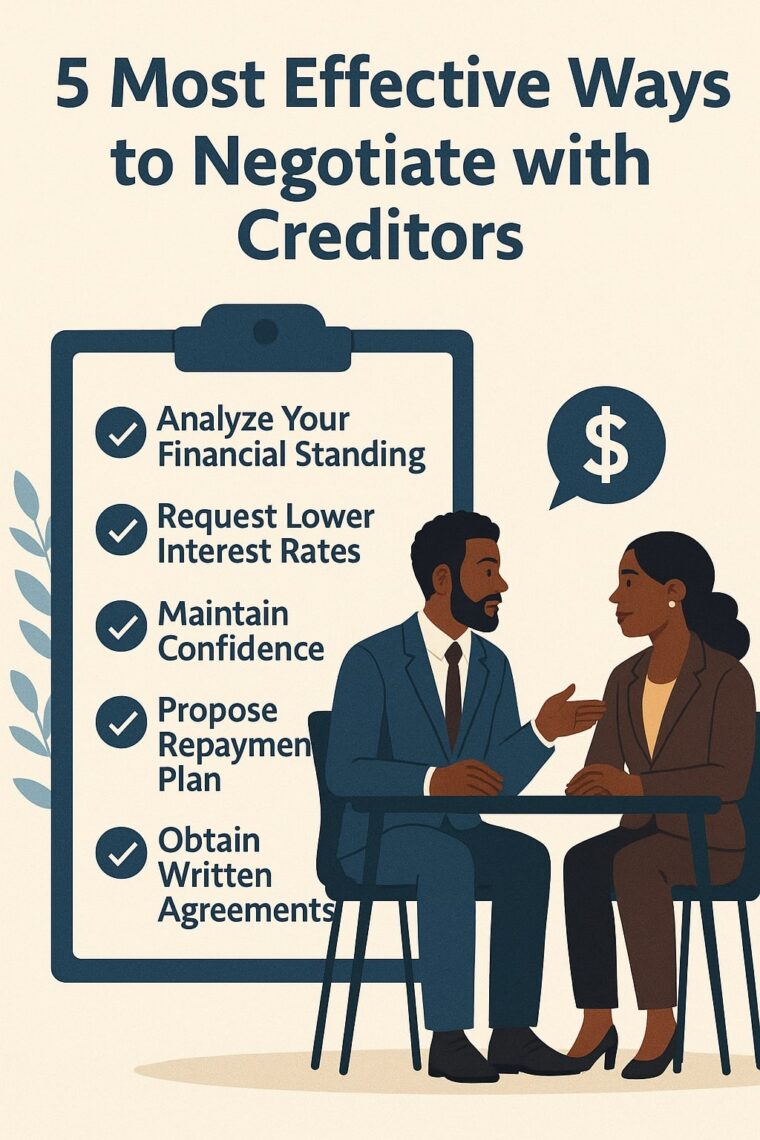

Negotiate with Creditors: 5 Proven Strategies to Reduce Debt

Discover how to negotiate with creditors effectively using 5 proven strategies. Learn how to lower interest rates, set repayment plans, and avoid financial stress.

Negotiate with Creditors: 5 Proven Strategies to Reduce Debt Read More »