The Dreaded Ds: Bouncing Back from Financial Shocks

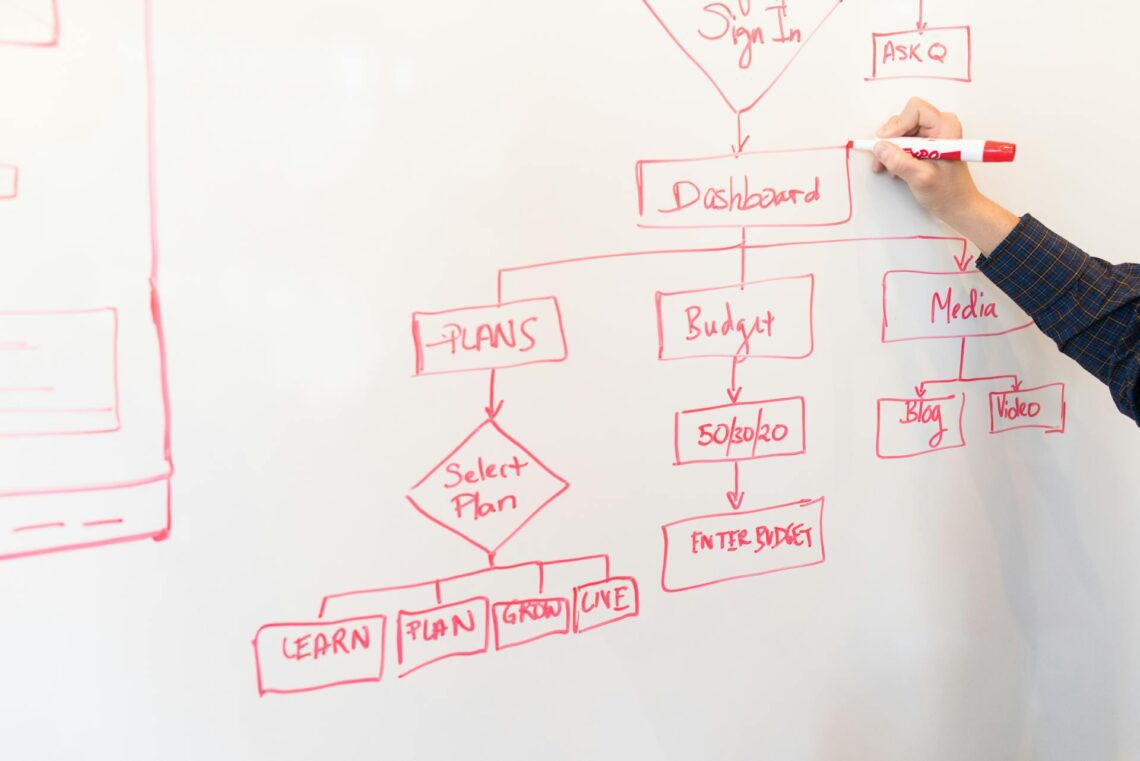

Recovery playbook for job loss, bereavement, and other shocks with an action-first approach. Experiencing a financial shock recovery can be one of the most challenging aspects of life, particularly when it stems from job loss, bereavement, or other unexpected events. These situations can create a ripple effect that impacts not only your financial stability but […]

The Dreaded Ds: Bouncing Back from Financial Shocks Read More »