6 Common Lies Debt Collectors Will Tell You

If you’ve ever had to deal with debt collectors, you know that many of them can be extremely persistent, rude and even downright obnoxious. But

Debt is a multi trillion dollar problem in America. If you look around you, you no doubt know somebody who has debt of some kind. You probably even have debt of your own you’re looking to pay off.

If you’ve ever had to deal with debt collectors, you know that many of them can be extremely persistent, rude and even downright obnoxious. But

UPDATE: As of March 13, 2020 – the date that President Donald Trump declared the coronavirus crisis a national disaster – your federal benefits such

You probably already know that it’s in your best interest not to ignore phone calls and correspondence from debt collectors, but what do you do when

If one of your personal or financial goals is to get out of debt this year – or at least eliminate your debt as soon

The inauguration of Barack Obama as the 44th President of the United States ushered in a new era. As he said in his speech on

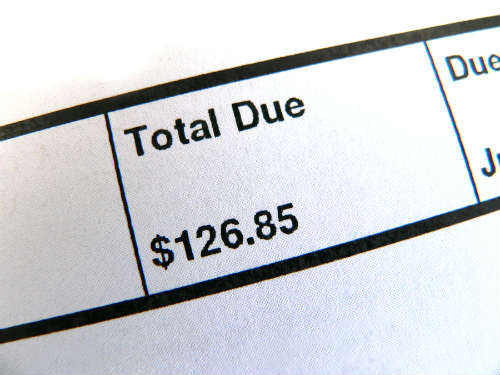

Creditors can sell your debt. When your debt is sold to collectors, some might use the threat of court action to try to intimidate you in order to get you to pay up.

Technically, it is illegal for collectors or creditors to threaten court action if they do not intend to carry through with it. Taking you to court is time consuming and expensive for them, and there is no guarantee it will result in the outcome the creditor wants. So typically, a court action is a tactic to get you to pay up, or to obtain a default judgment against you if you don’t respond to a summons and complaint.

In my book, Zero Debt, I explain how I got into debt (mainly via overspending), and also what it took to get me out of

A woman needs advice on wheter to pay off her debt or use her money to buy a second home. Click now to hear Lynnette’s advice.

If you had asked me before today if you could get get locked up for having outstanding credit card bills, I would have said: Absolutely

Don’t pay them anything. Send a cease and desist letter in which you tell them to stop contacting you. Harassing people about debts (old debts, like yours, or current ones) is illegal under the Fair Debt Collection Practices Act.

A woman is in a 5 year debt management program but wants to get out of it. What should she do?

Paying so-called minimum payments now actually ends up costing you more – a lot more – over the long haul. The math behind some of the calculations that determine your interest rate can be tricky. And I won’t get into all the complex, and sometimes mind-boggling formulas that are used to calculate your Annual Percentage Rate (APR). But suffice to say that for every $1,000 you owe, if you paid a minimum of say 4%, you’d only be paying $40 a month. With just $2,500 in debt on a card with an 18% interest rate, you’d spend 10 years paying it off and you’d pay more than $1,400 in finance charges on top of what you originally spent.

Debt is a massive problem in America. We’re up to our eyeballs in debt of all types: mortgage loans, credit cards, student loans, automobile loans. Moreover, the average mortgage balance in the U.S. is about $200,000; the typical family carries a monthly credit-card balance of $10,000; the average college graduate owes more than $20,000 in student loans; and the median car note now exceeds $27,000. Is it any wonder that Americans owe $2.5 trillion in consumer debt, excluding their mortgages? Throw in another $14 trillion in home loans, and it’s clear why our collective debt won’t go away any time soon.

Q: I Live in Michigan and Lost My Job in May 2009. I have Quite a Bit of Credit Card Debt that is in My Name Only. My Only Income is Unemployment. I Do Not Have a Bank Account in My Name. My Unemployment is Deposited to My Husband’s Bank Account. If I am Sued, Can a Creditor Seize My Husband’s Account Even Though It Isn’t His Debt, since the Unemployment is Going Into His Account?

Question: I am a 23-year-old college student with a bad debt of about $12,000 with American Express. I believe the Statute of Limitations in Maryland

©2009-2023 TheMoneyCoach.net, LLC. All Rights Reserved.

RSS / Sitemap /Submit an Article / Privacy Policy / LynnetteKhalfaniCox.com

Do Not Sell My Personal Information / Acceptable Use Policy / DSAR / Cookie Policy

Disclaimer / Limit the Use of My Sensitive Personal Information /