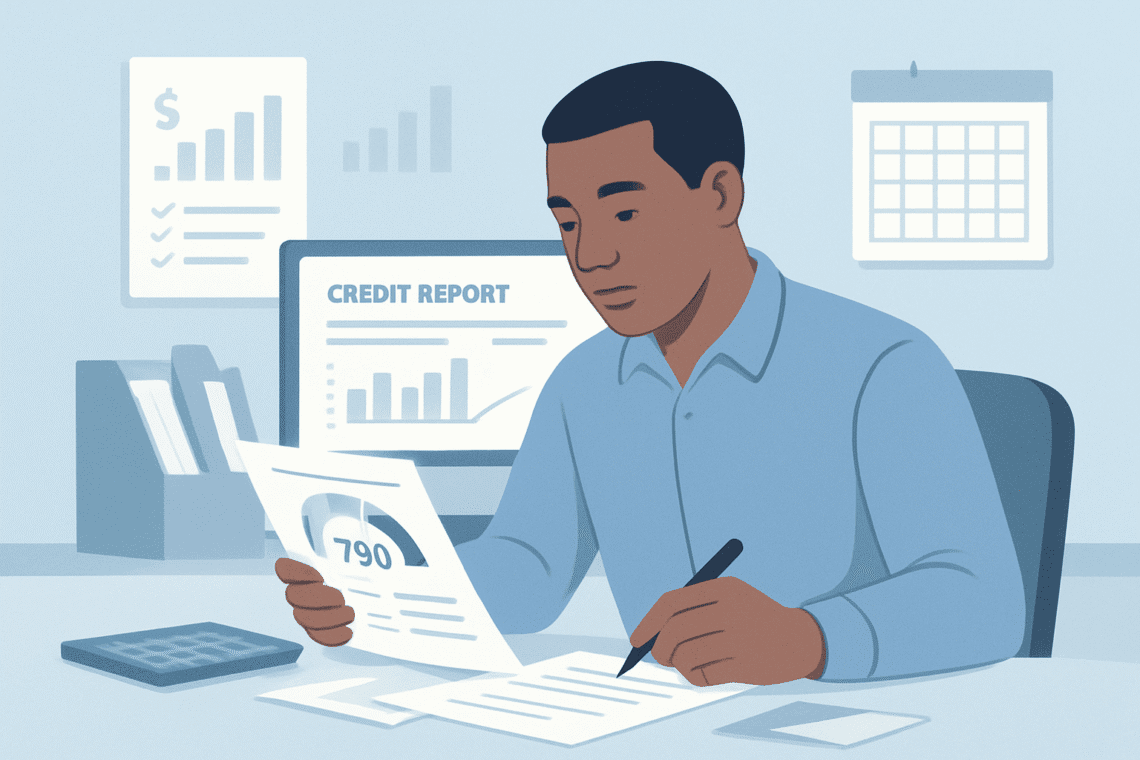

The Fastest Way To Improve Your Credit Utilization Ratio

Your credit utilization ratio is one of the most important factors in your credit score—and one of the easiest to control. This ratio shows how much of your available credit you’re currently using. Understanding and managing it can help you improve your credit score, qualify for better loan rates, and maintain financial stability. In this […]

The Fastest Way To Improve Your Credit Utilization Ratio Read More »