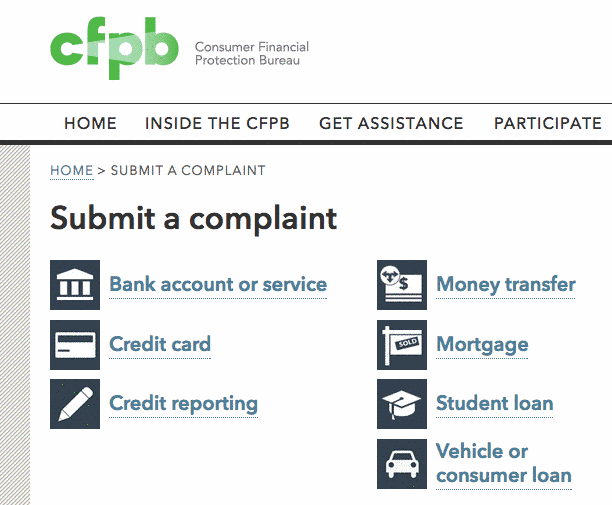

What is the Consumer Financial Protection Bureau (CFPB)?

The Consumer Financial Protection Bureau (CFPB) was developed by the U.S. Government to protect consumers against fraud and tricks from credit card companies, banks and other financial institutions. The CFPB acts as a regulator of all consumer financial service providers, which includes online banks, credit card issuers, payday loan providers and other lenders. Today, all […]

What is the Consumer Financial Protection Bureau (CFPB)? Read More »