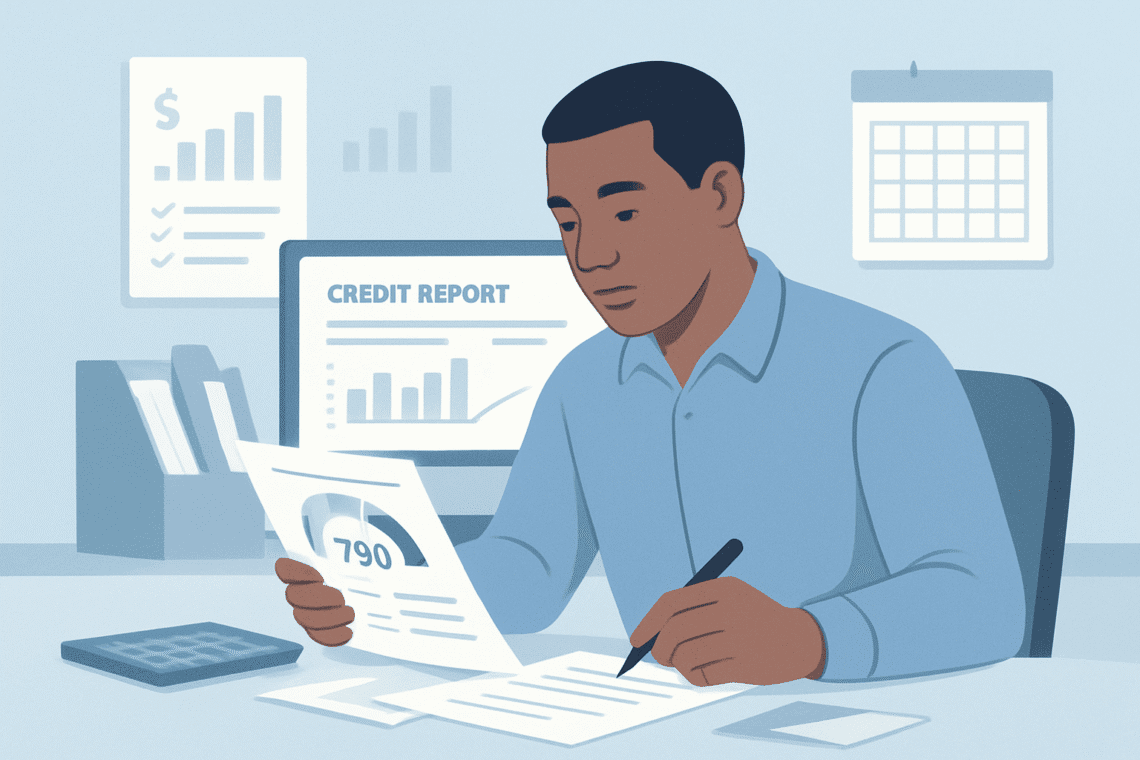

Decoding ‘CRTV’ And ‘CVAL’ Credit Report Codes Beyond The Basics

CRTV and CVAL credit report codes are used by credit bureaus and lenders to communicate specific account statuses on your credit report. Understanding these codes helps consumers and professionals accurately interpret credit data and resolve discrepancies. This guide explains what CRTV and CVAL mean, their implications, and how to confirm their meaning with lenders or […]

Decoding ‘CRTV’ And ‘CVAL’ Credit Report Codes Beyond The Basics Read More »