What Exactly Is Perfect Credit?

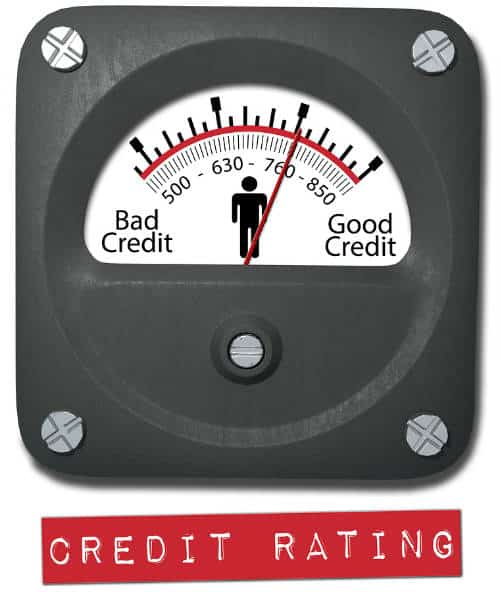

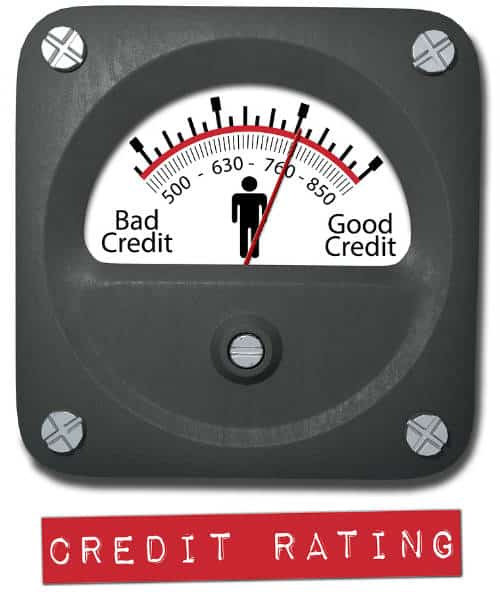

If your FICO credit score falls between 760 and 850 points, you rate among the top tier of all consumers and have the cornerstone for what I call Perfect Credit. Getting a great FICO score, however, is just part of the achievement. Fair Isaac reports that, among consumers with credit scores of 760 or higher, only 1% risk defaulting on a debt. So having Perfect Credit also means being able to access a whole host of products and services—mortgages, automobiles, credit cards, business lines of credit, and personal loans—at the most favorable terms available in the marketplace. Once you snag that impressive credit score, and all the benefits it entails, does having Perfect Credit today mean you’ll have Perfect Credit tomorrow? Unfortunately the answer is “no.”