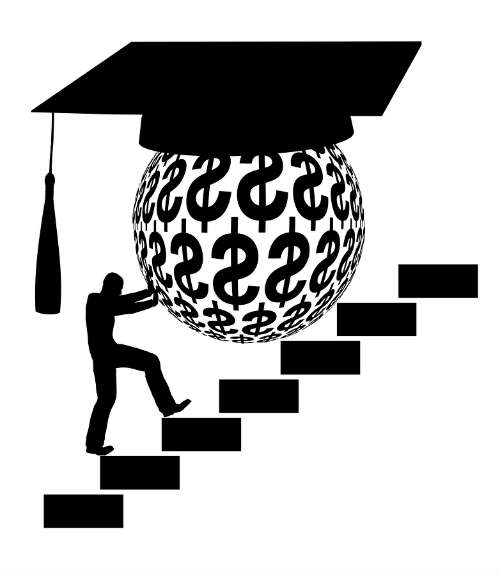

Some Old Debts Are Best Left in the Past

Q: I opened A credit card account back in college in the year 2000. I have never paid it off the amount I owed. Should I pay it or not? A: If the credit card is still open, then by all means pay if off if you can. But I think your question is referring to […]

Some Old Debts Are Best Left in the Past Read More »